Construction machinery industry expects a year of declines

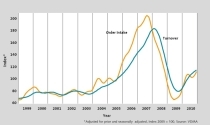

A nominal increase in sales of eleven percent – 4% in real terms – brought manufacturers in Germany a record year in 2023. This growth is based exclusively on working off order backlogs from previous years.

Manufacturers are expecting a double-digit decline in sales for 2024. The building construction machinery segment has been hit the hardest with a 40% drop in order intake in the period from January to December 2023 compared to the same period last year. This is due to the situation in residential building construction with high interest rates and construction prices. The decline in sales for earthmoving and road construction machinery will be much more moderate. Projects, for example in broadband expansion, energy and transport infrastructure, are continuing.

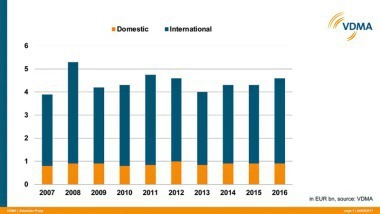

Just like the sub-sectors, the market regions are also very heterogeneous. Global construction machinery sales fell by 1.5% in 2023 compared to the previous year. Due to its property and economic crisis, China once again brought up the rear with a decline of 38%. By contrast, North America, now by far the largest market, grew by 21%. India experienced significant sales growth of 16% in 2023. Europe was able to confirm the high level of the previous year with a flat sales trend in 2023.

“We expect the strongest impetus this year to come from North America, Europe and India. However, if the North American market collapses due to political upheaval after the election, we will have to prepare for difficulties,” emphasised Franz-Josef Paus, Chairman of VDMA Construction – Equipment and Plant Engineering, at the annual meeting on 9 February 2024 in Frankfurt.

“China has virtually ceased to exist as a sales market for construction machinery manufactured in Europe,” added Joachim Strobel, Chairman of the VDMA Construction Equipment Division, “Chinese manufacturers are increasingly pushing into the European market. There is a suspicion of unfair competition, for example through price dumping or disregard for European safety requirements. In addition to the market supervisory authorities, every machine operator is also required to act responsibly when it comes to procurement.”