Sub-Saharan upswing continues

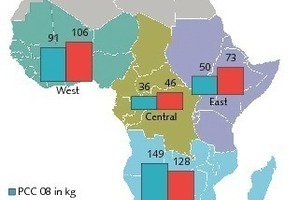

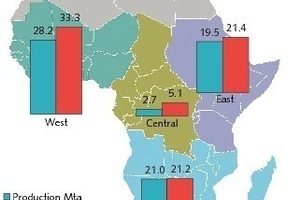

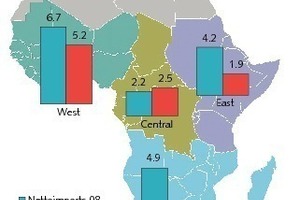

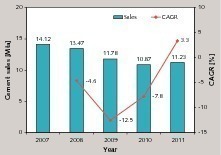

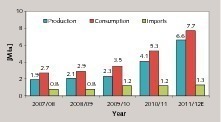

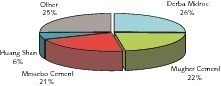

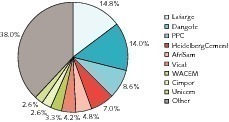

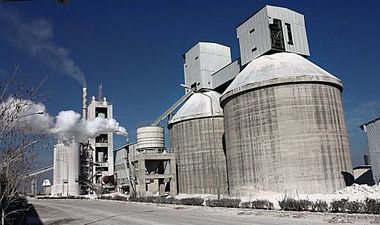

At the moment, the increase in cement production on the African continent is predominantly taking place in the Sub-Saharan area. This market report discusses the current developments, presents an overview of production capacity expansions and focusses on the leading countries of Nigeria, South Africa and Ethiopia.

1 Introduction

Within the space of just a few years, cement production capacities in the area have been dramatically expanded. In 2008, its largely obsolete production...