India – Gypsum demand and supply

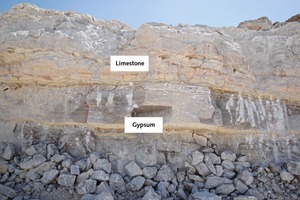

The cement industry in India is continuously growing. According to various research reports and in view of the upcoming massive infrastructure developments, the Indian cement consumption is expected to increase at a rate of 9-11 % per year. The rising costs of raw materials like gypsum (Fig. 1) and coal have been playing a heavy strain on the cement and construction industry. As result, Indian cement and plaster board companies have to explore alternate sources of gypsum and coal.

India‘s cement manufacturing capacity may increase to 479 million t/a by the terminal year of the Plan XII, ending 2017, despite the existing over capacity scenario, as per projections made by a Planning Commission Working Group on the sector. The working group, which has already submitted its final report to the commission for preparing the roadmap for the sector in the plan period (2012–17), has projected an 10–11.75 % growth in demand, production and the installed capacity of cement during the five-year period.

According to the Cement Manufacturers Association (CMA) and AT Kearney, India’s cement production will expand to 550 million tons by 2020 and its annual per capita use of cement will rise to 350 kg from 150 kg. McKinsey & Company is targeting to achieve 860 million tons cement capacities by 2030. According to the various research reports and in view of the upcoming massive infrastructure projects, cement consumption is expected to advance at around 10 % CAGR growth during 2012–2014 and thereafter around 9–11 % per year, which is anticipated to strengthen the long-term investment viability of the Indian cement industry.

The rising cost of energy, transportation and persistent raw material pressures (like gypsum and coal) have been placing a heavy strain on the cement and construction industry. As a result, Indian companies have to explore alternative sources of energy and raw materials.

Local natural gypsum

Imported natural gypsum

By-product gypsum

Union budget 2011, decided to bring down the import duty on the “critical raw material gypsum” by half to 2.5 % along with coal, the cement industry has been requesting a reduction in import duty on gypsum and coal from 5 % to nil to partly offset the rising manufacturing costs. In February 2011, the department related Parliamentary Standing Committee on Commerce recommended 0 % import duty on gypsum.

Local natural gypsum availability in India

By-product gypsum in India

Imported natural gypsum

At present, the Thai government has taken steps to stop new mines being opened and controls gypsum exports through a quota system, and has also divided the export market into different segments that prevent exporters from expanding into new markets. This has increased the selling price of Thai natural gypsum exports, but not significantly. “Substantial price increases may go against the agreements made by the World Trade Organization (WTO), of which Thailand is a member, and in this case the Thai government would have only one option: to stop gypsum exports at the earliest opportunity to take care of the country’s long-term local consumption needs”.

Importing gypsum from Iran is becoming difficult because of various restrictions/sanctions imposed by US/UN, and there have been challenges concerning payments to Iran, however few Indian traders are importing gypsum from Iran, routing the payment mechanism through other Iran friendly countries. According to the latest data, even banks from countries which do not ban financial ties with Iran may be reluctant to extend financing for fear of jeopardizing their US business, or because they fear being disclosed in the event of future sanctions. In June 2010, the UAE central bank told financial institutions to freeze Iran-linked accounts belonging to firms targeted by UN sanctions. ”Now, none of the UAE banks are opening a new account and letter of credit for any Iranian traders. Long term sustainable import of gypsum from Iran will continue to be a major risk for Indian gypsum consumers.

According to the Planning Commission Working Group on cement sector in view of the demand and installed capacity growth projections, the additional installed capacity (in addition to the present capacity of 323 million tons) requirement during the next 15 years (up to 2027) would be approx. 1050 million tones, as indicated in Table 1.

Opportunity for the Sultanate of Oman

The Port of Salalah already started their massive expansion to handle the future general cargo including gypsum exports from the Sultanate of Oman. The 130 million US$ expansion projects will be completed by 2014 for handling a capacity of 40 million t/a of dry bulk commodities. The expansion program includes building 1266 m of linear general cargo berths with drafts of 18 m. This expansion is 100 % required in order to serve the local requirements.

“Even though gypsum accounts for just 2 to 3 % of the total cost of cement sales, Indian cement manufactures are likely to face issues regarding availability and costs of gypsum in the near future. They will be increasingly at the mercy of imported natural gypsum; it is against this backdrop potential that a supply of gypsum from Oman becomes a very interesting prospect and Oman gypsum exporters can forecast their FOB selling price above 16.50 US$ per ton in coming years. Indian cement manufactures can easily accept this price range, because this is going to be a minor cost increase of the total cost of cement sales and it can be adjusted against local cement transportation cost/and a marginal increase on the cement selling price etc”.