New multi-client market report “Oil Well Cements 2020”

OneStone Consulting S.A. in Barcelona, Spain has released its new multi-client market report “Oil Well Cements 2020”. This report is intended as the standard workbook for cement producers and oilfield service companies for a number of years. The oil well cement market is analyzed in more detail than has ever been covered before and takes into account the latest oil price development.

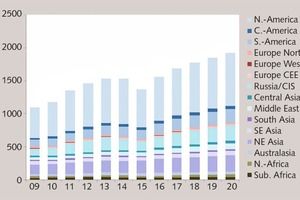

“We are seeing an average decline of 10.2 % in global demand with variations from country to country and the USA and Canada being hit most”, said Dr. Joe Harder, OneStone’s Managing Director and Senior Researcher “However, we forecast that the market will start to recover later this year and that for the period 2014-2020 an annual compound growth rate (CAGR) of 3.0 % will be achieved, with large variances in different countries and world regions”.

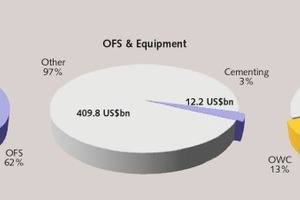

According to “Oil well cements 2020” the market potential for oil well cement (OWC) is 13 % of the global well cementing market (Fig. 1 and 2). In 2014 regional exports stood at 8.6 % of the OWC production. This is a much higher proportion than in the grey cement market (OPC). There are many other differences between OWC and OPC. OWC travels over much longer distances from the production plant to it’s final destination (on- and offshore wells), the transportation mode is very different and the mode of delivery is also different.

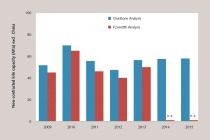

Most of the findings in the report have never been published before, such as the specific oil well cement demand per well. In the report this figure is given for 90 countries including the 60 major oil & gas exploration countries. Up to now only rig counts and the cement demand per rig have been used, with 1200 tons OWC per rig as a benchmark. According to Joe Harder such figures do not give a realistic picture of the market.

“We based our market analysis on the well counts per country, derived from the well data of the oil & gas exploration and production companies. For us, published data on international well counts was not reliable enough”, Joe Harder said. The well counts in the countries were linked with the cement demand of these countries. Most of the cement figures were directly received from the cement industry. “So, with our approach we were able to review the historical figures from 2009 to 2014 and provide a forecast from 2015 to 2020”, Harder continued.

The new market report comprises all important market data about the oil well cement industry including, global capacity, capacity of the top producers, market shares in the regions, market potentials, OWC demand, imports, exports, types of OWC used, prices and price development. For each country the demand, specific demand and cement types are given. Furthermore for each country the on- and offshore well counts with exploratory and development breakdown and well lengths are provided as base figures for cement demand.

The economies of scale of OWC are also reviewed, starting from price expectations of prospective investors, and reviewing capacities of producers, local and regional demand and strategies of suppliers such as Lafarge, Cemex and Dyckerhoff. The market definitely offers prospects, but margins decline with lower capacity utilization and the capacity utilization rates of most producers are not more than 60 % on average.

The new market report is intended for companies which are in any way involved in the production and use of oil well cement, including cement producers, cementing service providers, oil & gas exploration companies and consultants which deal with these industries. The report has 265 pages and contains 417 charts and 93 tables. All the information is in an executive format.

//www.onestone.eu" target="_blank" >www.onestone.eu:www.onestone.eu