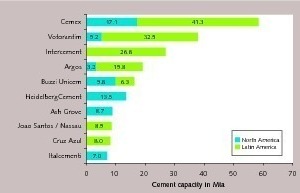

Lafarge-Holcim’s cement rivals in the Americas

Lafarge-Holcim will have the largest cement capacity of any of the cement producers in the Americas after their merger and sale of assets to CRH. In the following review we will discuss the implications of the merger, profile the major cement rivals in this region and look at the latest market developments in the major markets of the USA, Brazil and Mexico.

1 Introduction

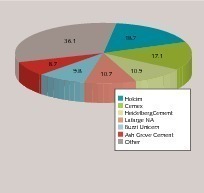

The cement industry benchmarks of North America and Latin America are very different. While cement prices are highest in Latin America (258 compared to an index of 100 for Asia Pacific), North America is, with an index of 191, closer to the global average of 173. But operating costs are highest in North America (index of 232 compared to 100 for Asia Pacific) and much lower in Latin America, with an index of 126, which is below the global average of 146. Finally, replacement costs for cement capacity are indexed at 250 for North America and 130 for Latin America (compared to an...