Smart pricing strategies in the pandemic

For the optimists, Corona is already water under the bridge. If you believe the pessimists, the worst of the pandemic is still to come. But one thing is clear: the industrial economy as well as the construction sector are already feeling the repercussions.

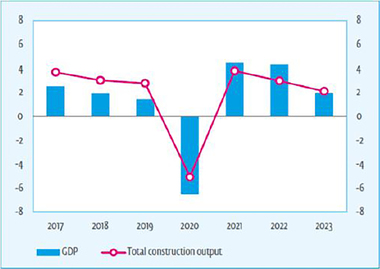

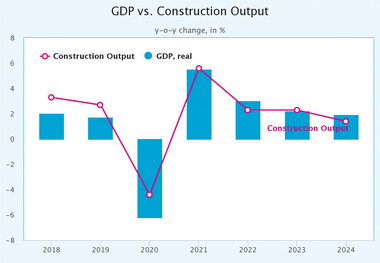

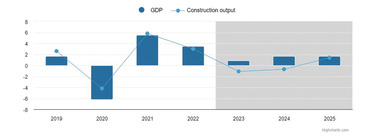

First, it is important to realize that the Corona crisis has dynamically shifted through different phases over the past months and will be going through more phases in the months ahead. What does that mean for sales volumes and raw material costs? What possible price scenarios result? With a confident pricing strategy, it is possible to secure orders and margins (Figure).

The Corona crisis is a crisis of volumesa and not of prices

Phase 1, with worldwide shutdowns predominantly in the first six months of 2020, was marked by a stark decline in demand for many products, especially for cars (-78 % new car registrations in Europe), aerospace, travel, tickets or machines (down to -80 %). The value creation of the German construction industry was still able to increase by +4 % in the first quarter of 2020. Since April, strict hygiene regulations, construction restrictions owing to a lack of material supplies, an increase in workers calling in sick and a rising number of cancelled orders have led to a heavy impact on the construction sector.

While the German construction industry was able to report 8.2 % growth in 2019, this year a real decline in sales of -3 % is expected. With this outcome, the construction sector has fared much better than other branches in this crisis. The approved government support schemes will additionally boost the construction industry – even in 2021 and beyond.

What does the moderate decline in volumes mean for prices? Representatives of the Deutschen Bauindustrie e.V. (Federation of the German Construction Industry) expect a mild effect on the construction sector. The price index for the building of new residential and non-residential construction in Germany has risen so far this year by 3.4 % compared to the previous year. In comparison with this, in the USA the construction-cost-index (CCI) has increased by 11 %, while in Europe it has gone up by 5 % (Germany by 4 %). The trend is still pointing upwards. Moreover, domestic products made of concrete cost 4 % more than in 2019. The fall in prices feared in many branches, like automotive or plant engineering, is not noticeable in the construction sector.

The Corona crisis is therefore, if anything, a crisis of volume or orders, but not a crisis of prices. There is absolutely no reason to cut prices. On the contrary, any supplier in the construction branch who does not increase their sales prices by at least 4 % lies under the market price benchmark for their customers!

Making cautious and fair price decisions in a time marked by solidarity

For weeks now we have been in the middle of Phase 2 of the pandemic with the reopening of public life at the same time as strengthening of the health care sector. Here for companies in the construction industry, over the next months it will be a matter of continuing to protect employees and at the same time of sustainably restoring normal business and day-to-day work. Supply reliability and financial stability are therefore important buying criteria for customers. Price increases are possible providing these are communicated effectively.

However, securing the availability of goods costs the producers of construction products much more on top. The investments and running expenditure to safeguard health in the company and for the supply chains (hygiene measures, changes in company procedures) are leading to considerable extra costs for the companies. Transport costs are also rising, while individual raw materials are becoming scarce and expensive. For example, isopropanol (rubbing alcohol for disinfection) rose from its normal price of 70 cent per litre to over 7 euros per litre at the peak of lockdown.

Assuring availability has added value for customers

As a result of Corona, manufacturers and distributors are often reporting considerable restrictions and additional costs depending on their branch. Postponed orders and partial underutilization are leading to increased extraordinary costs per sales unit.

In addition, a process of deglobalization is underway all over the world. Do customers really want to work with suppliers with long supply chains at the present time? Local proximity, service and trust gain importance in such crises.

At the present time there is absolutely no reason for price reductions

A 1-% price reduction effects on average a 15-% decline in profits for German companies. For a 5-% price reduction, profit would be lessened by 75 %. In a weak market, it is hardly possible to generate so much more sales volume with lower prices to make up for such a loss.

For this reason, better to increase prices – in a measured way and providing the increase can be justified, e.g. with cost increases for raw materials. But what is the situation when raw material costs have fallen, and customers are demanding discounts?

Recommendation A: Take a proactive approach in dealing with your top customers. Secure their custom with incentives other than prices. Reach out to your top customers before your competitors do. Instead of price discounts, offer added performance, additional services free of charge and innovations in the shared processes. Emphasize your quality – this is particularly important in the construction sector

Recommendation B: Instead of price discounts, offer a switch to other products, e.g. low-cost alternatives. In this way you can always easily tell how far the customer is willing to make technical changes in their production. If customers do not want to change a product from a well-known supplier, then the question is whether they would ever go as far as switching to the competition

Prices going up on the “rebound” – it is time to get ready now

As the third phase of the pandemic, we expect a strong recovery of the economy on the rebound on account of several aspects. Owing to resumption of work on construction sites that have been closed because of the pandemic, investors regain confidence and demand really picks up. Secondly, the German government and the states are planning big recovery packages. Even at the European level, programmes such as the “Next Generation EU” recovery programme or the “Greendeal” sustainability programme are running and supporting the construction industry when it comes to innovation, progress (e.g. energy-oriented refurbishment) and naturally the order situation. Here, it is clear how important it is to work together in solidarity and be there for each other, especially within Europe. The market prices will rise further on the rebound, as the Federation of the German Construction Industry Regd expects.

Companies from the construction industry should therefore get ready for the coming price increases. Companies wanting to increase their prices, for example at the beginning of next year, should prepare for this early on. Here, the five-step plan (intelligent segmentation, communication, sales training, negotiation planning, performance measurement) comes into play.

Especially in such difficult times, it is crucial to preserve a healthy mindset. Many companies are currently doing a terrific job in areas such as ensuring reliable goods supply and health protection. Anyone supplying this added value has also deserved commensurate sale prices. Now is the time to measure price discipline in sales on a monthly basis. At the same time, energize sales with well-prepared online training for successful pricing in the coming months.

Owing to the contact restrictions, numerous strategic opportunities result, especially in sales and price management:

Rethink your long-term channel price strategy. During the pandemic, the willingness to pay for digital services has changed. While these used to be available free of charge, today customers are prepared to pay for them. Online grocery shopping is currently worth more to the customer than standing in queues and wearing a mask in brick-and-mortar shops. Recalibrate your price level online vs. direct

Use the digital momentum to monetarize more of your services. Now is the time to introduce digital maintenance services, new business processes or online training and reliably supply customers remotely in future. How do you make these services attractive and what does this mean for the product prices? In a strategy sprint with pricing experts you can make your prices fit for the future

Experience from other economic downturns has shown: By making the right price decisions and setting the right course now, you can achieve 3 % points more margin.

//www.schuppar-consulting.com" target="_blank" >www.schuppar-consulting.com:www.schuppar-consulting.com