Cement Market Special: Pakistan

1 Economy and challenges

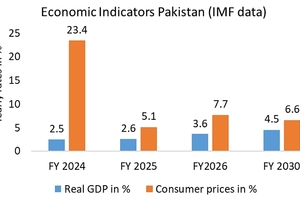

Pakistan has a population of 256 million (Sept. 2025) and is the 5th most populous country in the World. The population growth rate is 1.57% and the average age is 20.6 years. About 63.6% of the inhabitants reside in urban areas, whereas 36.4% live in rural parts. In 2025, the global ranking is 38th by nominal GDP and 25th by purchasing power parity (PPP). After a negative GDP growth of -0.2% in FY 2022/23 (Financial Year from 1. July - 30. June) and a consumer price increase of 29.2%, Pakistan has made important progress in restoring macroeconomic stability despite a challenging environment. Figure 1 shows the projections by the International Monetary Fund (IMF) for the two economic indicators [1]. Accordingly, after a real GDP growth of 2.6% in the last FY 2025, a growth rate of 3.6% is projected for this FY 2026, while consumer price growth will decline to 7.7%. For FY 2030 the projected GDP growth is 4.5%, while consumer price growth will decline to 6.5%.

The IMF reported that at the beginning of FY2024, Pakistan’s economy faced a potential economic crisis in the face of political uncertainty, global monetary policy tightening, and fiscal and external imbalances, that led to pressures on domestic prices and foreign reserves. For this year, Pakistan’s policy efforts have delivered significant progress in stabilising the economy and rebuilding confidence amidst global challenges. Fiscal performance has been strong, inflation fell to a historic low of 0.3% in April. Gross reserves stood at US$ 10.3 billion at the end of April and are projected to reach $ 13.9 billion by the end of June 2025 and continue to improve over the medium term. The poverty rate is expected to decrease from 42.3% now to 40.8% by FY 2027. The governmental debt is projected to decline from 73.6% of GDP to 70% by FY 2027 and 61% by FY 2030. According to the IMF, structural re-forms will unlock Pakistan’s competitiveness and create conditions to attract high-impact private investment.

Pakistan contributes less than 1% of the global CO2 emissions, but like many other countries from the Global South it is among the world’s most vulnerable to climate change impacts. Millions of residents are facing extreme weather events with increasing frequency. Catastrophic flooding in Lahore and across Pakistan’s Punjab region in the North at the border to India has left more than 1.5 million people affected and over 850 dead this monsoon season. Heavy rains and the release of excess water from India’s dams have swelled the Ravi, Sutlej, and Chenab rivers, devastating more than 1400 villages. Settlements and housing societies built on riverbeds or flood routes are reclaimed by nature. While the North faces glacial outbursts and flash floods, Southern provinces are battling an opposite reality: drought and desertification. The regions around Sindh and Balochistan have been facing acute water scarcity, increasing land degradation and droughts, which are destroying farmland.

2 The construction and cement sector

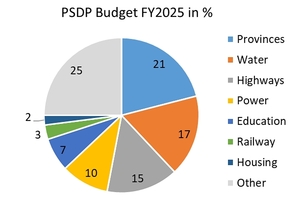

Pakistan’s construction sector contributed 2.5% of the GDP in FY2025 at current prices or 11.8% of the industrial sector. The PKR 1.1 trillion budget (3.87 US$bn) of the Federal Public Sector Development Program (PSDP) [2] was a major driver of the demand in FY 2025, followed by private investments in the construction sector. About 57.2% of the PSDP budget (Figure 2) has been disbursed as of the first 7 months in FY2025. With 21%, provinces and special development areas will receive most of the budget, followed by water resources with 17% and national highways with 15%. Education and the budget for schools is much larger than the federal budget for railways and housing. The China-Pakistan Economic Corridor (CPEC) is a vast infrastructure project, which is under development to connect China’s Xin-jiang region to Pakistan’s Gwadar Port via roads, railways, and energy projects (Figure 3). The corridor is considered to be an extension of China’s ambitious ‘Belt and Road’ initiative (BRI).

The cement industry in Pakistan is part of the large-scale manufacturing (LSM) sector, which makes up about 73% of the manufacturing sector, with the cement industry contributing about 6% of the LSM subsector. Anyhow, the cement industry has 16 companies with 27 operational plants across the country. The capacity was 86.7 Mt/a in FY 2024 and operates in two different zones, 66.4 Mt/a in the North and 20.3 Mt/a in the South, according to our research. A major cement demand is created by the growing population and urbanisation, which also creates a continuous demand for new housing units and supporting infrastructure. Today, the shortfall in housing is estimated to be 9-10 million units. The Public Sector Development Program (PSDP) on large infrastructure projects like dams, roads, and bridges, the CPEC initiative, as well as the private sector investment by the industry are additional cement drivers. However, it needs to be noted that the Central Bank’s monetary policy and high inflationary pressures have led to lower levels of local dispatches.

3 Cement development in recent years

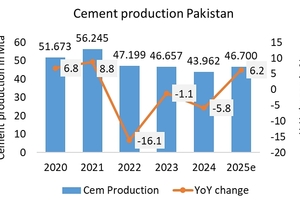

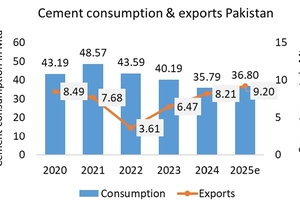

Figure 4 shows the development of the cement production in Pakistan in recent years (by calendar year) [4]. There was a peak in cement production in 2021 with 56.245 Mt/a. After a huge decline due to the Corona crisis and an ongoing decline due to a relatively weak economic growth, cement production declined to 43.962 Mt/a in 2024. Only since the beginning of this year, there has been a significant increase in cement production. Anyhow, Figure 5 demonstrates how the cement production splits up into local consumption and exports. Cement imports by Pakistan are almost non-existent. Consumption peaked in 2022 with 48.57 Mt/a, to undergo a major decline by 2024 with only 35.79 Mt/a. Cement exports also declined from almost 8.5 Mt/a in 2021 to 3.6 Mt/a by 2022. However, since 2023 exports have been significantly increasing, with a new peak of probably 9.2 Mt/a in this year.

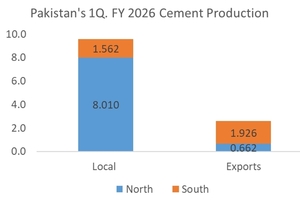

The latest cement dispatches by Pakistan’s cement producers in 1Q FY2026 were 12.161 Mt. This is an increase by 16.3% YoY, when compared with 10.461 Mt in 1Q FY2025. In this quarter, 9.572 Mt (78.7%) of the dispatch were local, while 2.589 Mt were for exports (Figure 6). Of the total dispatch in 1Q FY 2026, about 8.672 Mt (71.3%) were produced by North-based mills (North), while 3.489 Mt (28.7%) were produced by South-based mills (South), where about 29.2% of the population are living. About 8.010 Mt or 83.7% of the local cement has been consumed in the North, while 1.563 Mt or 16.3% has been consumed in the South. Exports show the opposite situation.

In August this year, 1.926 Mt or 74.4% of the total cement ex-ports by Pakistan were from the South, while only 0.662 Mt or 25.6% were from the North. The main cement export destinations are Afghanistan, Madagascar and Somalia, while the main clinker export destinations are Bangladesh and Sri Lanka.

4 The major cement producers

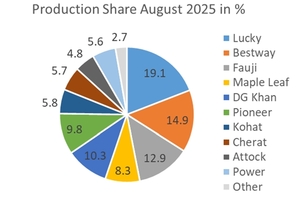

The Pakistani cement industry declined to 16 companies after Askari Cement merged with Fauji Cement in October 2021. At the end of 2024 the cement capacity stood at 86.7 Mt/a. Lucky Cement has the largest capacity, with 17.6% from 2 plants totalling 15.3 Mt/a, of which 10.2 Mt/a capacity is in the North and 5.1 Mt/a in the South (Table 1). Bestway Cement is 2nd in the rankling with a capacity of 17.5% from 5 plants, which are all in the North. 3rd in the ranking is Fauji Cement with 4 plants and 10.6 Mt/a capacity in the North. The Top 10 companies, also including Maple Leaf, D.G. Khan, Pioneer, Kohat, Cherat, Attock and Power Cement comprise 91.9% of the capacity. Of the total capacity, 66.4 Mt/a or 76.6% are in the North, while only 20.3 Mt/a or 23.4% are in the South. Figure 7 contains the estimated shares in Pakistan’s cement production in August 2025. Lucky Cement has been the clear market leader with a production of 0.736 Mt or 19.1% (of which 0.522 Mt have been produced in the North and 0.214 Mt in the South), followed by Bestway Cement with 14.9% and Fauji Cement with 12.9%.

In FY 2025 (which ended 30th of June this year) Lucky Cement, which was founded in 1993 and which is the flagship company of Pakistani Yunus Brothers Group (YBG), had a net revenue of PKR 449.6 bn (about US$ 1.59 bn) and a profit before tax of PKR 106.1 bn (23.6%). The company operates the Pezu plant in Khyber Pakhtunkhwa in the North and the Karachi plant (Figure 8) in Sindh in the South. Lucky Cement is the largest cement producer in the country and also the undisputed cement and clinker export leader, resulting in a total export dispatch of over 3 Mt/a in FY 25. Export regions and countries included West Africa, East Africa, Indian Ocean Islands, Bangladesh, and Sri Lanka as well as American markets in the USA and Brazil, recently. Lucky cement is on an international expansion with cement plants in Iraq and DR Congo. The company produces different variants of Ordinary Portland Cement (OPC), sulphate resistant cement (SRC) and composite cements to meet the diverse needs of its customers.

Bestway Cement Ltd. (BCL) operates eight production lines installed at five locations in the North in Hattar, Farooqia, Chakwal, Kallar Kahar and Mianwali (Figure 9). In FY 2024 the company achieved a revenue of £ 317.0 m (US$ 427.8 m) and a profit before tax of £ 53.1 m (16.8%). In FY 2024, BCL’s total cement dispatches increased by 6%, which was higher than the industry growth. This was mainly due to two new production lines at Hattar and Mianwali that came online during February and March 2023 respectively. Fauji Cement operates the 4 plants Jhang Bahtar, Nizampur, Wah (Figure 10) and Dera Ghazi Khan. In FY2025 the company achieved a cement production of 5.38 Mt/a, which corresponds to a capacity utilisation of 51%. The gross revenue has been PKR 131.4 bn (US$ 460 m) and the profit before tax PKR 13.3 bn (10.1%). The Company’s primary export market is Afghanistan due to the strategic location of its plants.

Maple Leaf Cement is a cement manufacturer based in Lahore, the capital and largest city of the Pakistani province of Punjab. The company operates a clinker capacity of 7.8 Mt/a and a cement capacity of 8.1 Mt/a. D.G Khan Cement is the next in the ranking with 3 plants in Dera Ghazi Khan in the North and Khaipur (Figure 11) in Chakwal and Hub in Balochistan in the South. Pioneer Cement, Kohat Cement and Cherat Cement have their capacities in the North. The Chenki plant (Figure 12) of Pioneer is located in the heart of Punjab Province, 250 km from Lahore. Kohat has a clinker capacity of 4.8 Mt/a (Figure 13) and a cement capacity of 5.1 Mt/a and achieved a sales revenue of PKR 37.5 bn. The other two companies of the Top 10, Attock Cement and Power Cement have their capacities in the South. The list of Pakistan’s cement producers is completed by Dewan Cement (2.9 Mt/a capacity), Gharibwal (2.01), Fecto (1.0), Flying Cement (0.72), Thatta Cement (0.69) and Dandot Cement (0.5 Mt/a).

5 Capacity expansion and utilisation

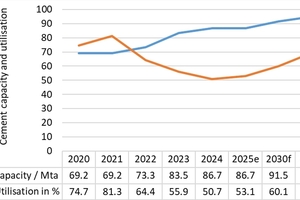

Figure 14 shows how the cement capacity in Pakistan has developed since 2020 and what is projected up to 2035 by calendar year. In 2020 and 2021 capacity was constant at 69.2 Mt/a, while cement production achieved a peak in 2021 at 56.245 Mt/a and capacity utilisation increased from 74.7% to 81.3%, which was also the highest over the last 2 decades. However, capacity increased, while production declined in the next few years. The lowest capacity utilisation was registered in 2024, when only 50.7% was achieved and the Pakistani cement industry suffered most, due to declining prices and increased production costs. However, in this year the expectation is that a cement production of 46.0 Mt/a will be achieved and the capacity utilisation will slightly increase to 53.1%. For the coming years, with moderate capacity expansion and a significant growth in cement production, capacity utilisation is projected to grow to 60.1% in 2030 and 69.5% by 2035.

Projects announced earlier by Maple Leaf, Kohat Cement and Fauji Cement have faced delays due to financing constraints and high equipment import costs under the current exchange rate regime. However, Fauji Cement Company Ltd. (FCCL) commissioned its greenfield Dera Ghazi (DG) Khan cement plant with a nominal capacity of 6500 t/d of clinker and 2.3 Mt/a of cement (Figure 15). In 2024, Kohat Cement, having a market share of less than 6.0%, increased its kiln line capacity from 6700 t/d to 7064 t/d by means of a pyroprocess optimisation. The Kohat cement factory is located in the Khyber Pakhtunkhwa province, about 150 km west of Islamabad. Already 4 years ago, Kohat announced plans to build a large new greenfield cement production line in Khushab in the Punjab province, 120 km northwest of Faisalabad. The infrastructure development for this project is now in progress, however the plant order will be awarded only when the economic growth outlook is sustainable.

Flying Cement Limited has started its new cement production Line II in Mangwal, in the heart of the Punjab province in Pakistan. The new line comprises a 7700 t/d kiln with an ICL-preheater, a Cross-Bar-cooler and an OK 71-6 cement mill for 415 t/h of OPC. The plant contract was awarded to FLSmidth in March 2019. Plant commissioning was postponed from 2021 to 2024. Probably Line I will be closed when Line II is operational. Line I has a capacity of 4000 t/d and was supplied by Japanese IHI. Attock Cement Pakistan Limited (ACPL) has successfully completed a new Sinoma built cement production line at its plant in Hub, Balochistan (Figure 16) with a capacity 1.3 Mt/a. Sinoma TCDRI has also finished the 1600 t/d clinker capacity upgrade of the Dandot Cement plant in Lahore, Pakistan. Thatta Cement has signed a memorandum of understanding with China’s Qing Gong Construction to establish a new 5000 ton-per-day production line, a deal concluded during President Asif Ali Zardari’s state visit to China in February 2025.

6 Sustainability and Decarbonization

In 2023 about 16 Mt/a of CO2 was released by Pakistan’s cement industry, according to the Global Carbon Atlas. However, according to our calculations the real amount is closer to 25 Mt/a CO2. Most of these emissions are due to the conversion of limestone into clinker during the calcination process. The largest producer, Lucky Cement, who is responsible for about 18-19% of the cement production, released about 7.3 Mt/a of CO2 to the atmosphere during FY 2025 (3.2 Mta CO2 at the Pezu plant and 4.1 Mt/a of CO2 at the Karachi plant), while more than 0.64 Mt/a of CO2 emissions were prevented during FY 2025 by green energy initiatives (Figure 17). Lucky Cement Limited has expanded its renewable energy portfolio with a 42.8 MW solar power plant with 5.589 MWh storage at Pezu, a 31.5 MW solar project at Karachi, and a 28.8 MW wind energy project, which together produce over 212 GWh annually and prevent over 104000 t of CO2 emissions alone with projects last FY Year. The Pezu project is the largest on-site captive solar plant in Pakistan.

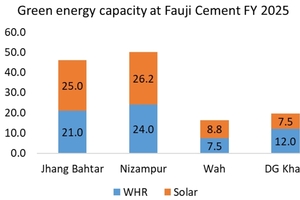

Waste heat recovery (WHR), solar and wind power have been major measures undertaken by the cement industry for decarbonization of the production, instead of investing in carbon capture, utilisation and storage (CCUS)-projects. Let us provide a few more examples. Fauji Cement, the number 3 in the Pakistan ranking, installed WHR and solar power systems at all its plants (Figure 18). In FY 2025, the nominal green power generation capacity was 132 MW. The largest contribution was by the Nizamour cement plant with 50.2 MW, followed by Jhang Bhatar with 46 MW. Another example is D.G Khan, who operate 3 kiln lines (6700 t/d at Dera Ghazi Khan, 6700 t/d at Khaipur and 9000 t/d at the new hub plant). According to company publications, the electricity requirements for all three plants are 113 MW, of which 32.4 MW are provided by the WHR systems in the plants.

7 Outlook

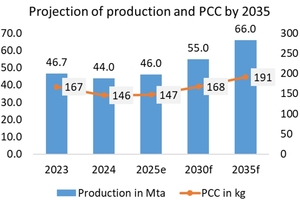

During FY 2025, average gross and net margins of the cement companies in Pakistan improved significantly, due to a better capacity utilisation, better prices and reduced inflation levels, which were on a record high of 38% in May 2023. The projected GDP growth of 4.5% in FY 2030 will also have a positive impact on the local cement and construction industry. Questionable are the future countries for cement exports, because the local capacities are increasing in neighbouring countries and existing export markets. However, our projection for 2030 and 2035 is positive (Figure 19), especially in the local market. The projection sees an increase in ement production from 46.0 Mt/a in 2025 by a CAGR of 3.6% to 55 Mt/a by 2030 and by a CAGR of 3.7% to 66.0 Mta by 2035. The local cement consumption will increase with a CAGR of 4.6% by 2030 and 4.4% by 2035, so that the per capita cement consumption (PCC) is projected to grow from 147 kg in 2025 to 168 kg in 2030 and 191 kg by 2035, keeping in mind that by 2035 the population will increase to 298.4 million.

Washington, D.C. 20090, USA

Ministry of Planning, Development and Special Initiatives, June 2025, Islamabad, Pakistan

2 updates per year by OneStone Consulting Ltd., Varna, Bulgaria