China:

TOP 10 combine 817 million tons capacity

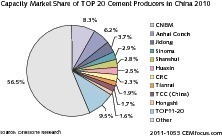

In China the TOP 10 cement producers comprise 817.4 Mta (34 %) of a cement capacity of 2405 million tons per annum (Mta). Market leader with a capacity of 200 Mta (8.3 %) is CNBM, followed by Anhui Conch with 150 Mta (6.2 %) and Jidong with 89 Mta (3.7 %). The next places in the ranking are taken by Sinoma Cement, Shanshui, Huaxin, CRC, Tianrui, TCC (China) and Hongshi.

TOP 11-20 companies, incl. BBMG, Jinyu Group, Lafarge, Yatai and Asia Cement combine about 9.5 % of China‘s cement capacity. Accordingly TOP 20 comprise 43.5 % of the capacity.

The only foreign producer in the TOP 10 beside Holcim (which have a 39.9 % participation in Huaxin) is Taiwan Cement Corp (TCC). Other major foreign cement producers in China include Lafarge, CRH, HeidelbergCement, Asia Cement Corp., Taiheiyo, Italcementi, Cimpor, Cemex and Cementir.

CEMfocus.com is a new market intelligence service for the cement industry and a trademark of OneStone Intelligence GmbH, a member of the OneStone Consulting Group GmbH in Germany. OneStone Intelligence GmbH has been providing services for the cement industry since March 1997. The new service will be offered from July 2011.

Highlights more than 30 cement industry topics such as demand projections, capacity expansions, cement production, exports/imports, trade, production costs, prices; TOP 10, major contracts, clinker substitution, technology trends, market potentials, market shares, mergers & acquisitions, emerging markets, company strategies ...

Market Reports

(country markets, companies & technologies to watch)

Three fixed price categories including Premium, Standard and Basic, plus additional Special Reports.

Additional information is available on the web site at