Outlook of the white cement industry

The market for white cement is growing fast, faster than the market for grey cement. However, white cement is less of a commodity and the market characteristics are not only very specific but also very different to grey cement. This article presents some of the latest findings of a new market report, which is essential reading for companies already active in white cement and companies interested in investing in this sector.

1 Introduction

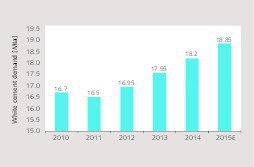

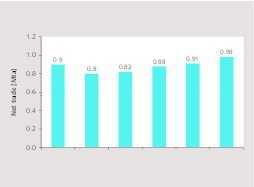

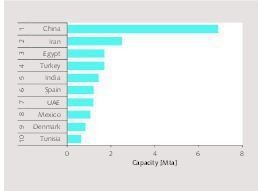

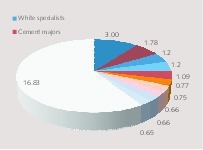

According to the new multi-client market report by OneStone Consulting the demand for white cement will grow by an average CAGR (compound annual growth rate) of 3.8 % between 2015 and 2020 [1]. This is actually higher than the antici-pated growth for grey cement. And interest in white cement is increasing. One reason is due to the higher sales prices and margins that can be achieved by white cement. Another is the premium nature of white cement in applications, which are driven by aesthetic and decorative aspects. Socio-cultural and marketing aspects also play an important role...