European construction market proves to be resilient, but recovery slows down

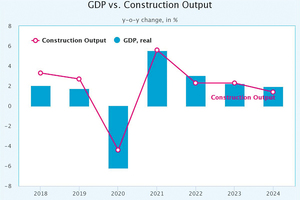

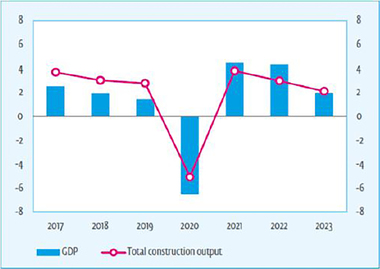

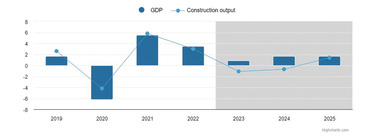

The construction industry within the 19 Euroconstruct countries recovered in 2021 after an unexpected decline in construction output in 2020 caused by negative socio-economic developments (national and sector-specific closures aimed at halting the development of the global Covid-19 pandemic). Following the 4.4% decline in 2020, construction output in the EC-19 increased by 5.6% in 2021 and additionally closed the gap to 2019.

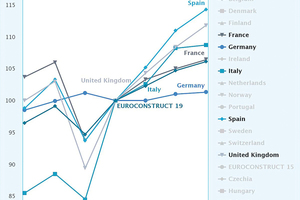

In 2021, among the 15 Western countries (EC-15), ten achieved higher total construction volume than in the pre-pandemic year 2019. Of the BIG-5 countries, only Italy surpassed its pre-crisis level in 2021 significantly (+13.0%, after a decline of 4.5% in 2020).

In Germany, the construction output in 2021 was close to the level of 2019 (+0.1%), while production was 5.7% lower in France, 3.2% in Spain, and 2.9% in the United Kingdom. All Nordic countries achieved a higher total construction volume in 2021 compared to the pre-pandemic year 2019, of which Denmark showed the highest growth (+17.8%).

Among the four Central and Eastern European countries (EC-4), only one achieved a higher total construction volume in 2021 compared to 2019, namely Poland (+1.5%). On the other hand, the construction industry in Slovakia experi-enced a deep recession with a decline of 16.8%.

According to estimates of the Euroconstruct summer 2022 forecasts, the total construction output in the 19 Euroconstruct countries amounted to € 1,854 billion in 2021. After an increase of 5.6% in 2021, total construction growth will slow down to 2.3% in 2022, and a similar rate is forecasted for 2023. Market instability resulting from the war in Ukraine and high inflation dampens economies’ propensity to invest and undertake new construction projects.

Within the forecast period 2022-2024, Euroconstruct predicts a cumulative increase in construction output in the Euroconstruct area. In the EC-15 countries of Western Europe, cumulated growth will amount to 6.1%, which is slightly lower than for Central and Eastern Europe (EC-4) countries where a rate of 6.4% is forecasted. The strongest cumulative growth is expected in Ireland (+15.1%), followed by Spain (+14.3%) and Slovakia (+13.5%).

Stagnant tendencies are forecasted in the largest European construction markets. Germany’s output declined in 2021 (-1.2%) after minor expansion in 2020 (+1.3%) and it is expected to expand construction output by less than 1.5% in the whole period 2022-2024.

The expectations for the Scandinavian countries are diverse, i.e. Finland and Sweden are considerably more negative and the production level is to decrease in the next three years in these countries. Norway and Denmark on the other hand expect a total increase by 3-4% in the forecast period 2022-2024.

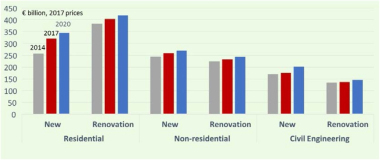

All three main segments of the construction market in the EC-19 countries will increase in real terms in 2022-2024, but the prospects of growth are rather moderate as the expected annual growth rates are 2% to 3%. This applies to building construction, civil engineering, and also to investments in renovation activities. Relatively low projected growth in construction over the forecast period reflects the high level of uncertainty about the direction of further economic developments in European countries.

The continued intensification and duration of the war in Ukraine, aside from a possible resurgence of the pandemic in autumn, raises the possibility of worsening economic developments around the globe and in Europe, which could lead to a recession in the construction industry of some countries and construction segments.

In the current projection for 2022-2024, Euroconstruct forecasts a significant slowdown in the growth rate of residential construction to 1.3% in 2024. This results from stagnation trends in both new residential construction and renovation (in 2024, growth is 1.5% and 1.2%, respectively).

After the sharp decline in total non-residential construction in the Euroconstruct market in 2020, production is forecast to recover in 2022-2024. However, non-residential construction will not return to pre-pandemic levels in several EC-15 countries, such as France, Germany, the UK, Finland and Ireland as well as in two EC-4 countries, Slovakia and Czechia.

Civil engineering was least affected by the adverse effects of the pandemic in 2020 (output decreased by only 0.4%) due to the implementation of many large infrastructure projects financed from national budgets and EU funds. Euroconstruct predicts civil engineering to grow by 2.7% per annum on average between 2022 and 2024. After accelerating to 3.9% in 2023, the annual growth rate will drop significantly to 1.7% in 2024.