Industry 4.0

Industry plays a central role in the European economy: It contributes 15 % to overall value added and accounts for 80 % of innovations and 75 % of exports. When taking into account industry-related services as well, industry is the engine of Europe‘s social economy. But the manufacturing sector has been under more and more pressure lately. Due to its declining competitiveness in the face of new market players – particularly from Asia – jobs have been lost in established markets such as the UK (‑29 %), France (-20 %) and Germany (-8 %) over the past 10 years.

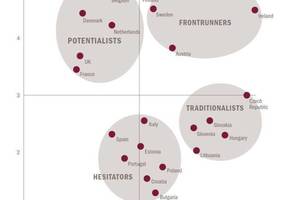

In addition, countries in Europe are developing differently. While Germany and Eastern Europe continue to increase their share of the industrial market, other EU members are facing de-industrialization. “This development will weaken Europe overall, because more jobs and know-how will be lost in industry. After automation, electrification and digitalization of industry, the introduction of the Internet of Things in the factory marks the advent of a fourth industrial revolution,” says Max Blanchet, Partner at Roland Berger Strategy Consultants. However, Europe is much better prepared for this new industrial revolution than many think. In their new study entitled “Industry 4.0 – The new industrial revolution – How Europe will succeed,” the Roland Berger experts explain what companies and politics should do to support the development of Industry 4.0 and leverage this opportunity for Europe.

Industrial production:

A strong shift in markets

Over the past 20 years, global sales in the manufacturing sector increased from just below € 3,500 billion to more than 6,500 billion in 2011. However, the shares individual countries contribute to global sales volume have changed considerably over this period: Western European industrialized nations with traditionally strong manufacturing sectors lost more than a 10 % market share to emerging regions such as Asia, Russia, South America and Africa. These were able to increase their industry market share to 40 %.

“This development and the increasing outsourcing of activities such as logistics, maintenance and other services have further undermined employment figures in Europe,” explains Roland Berger Partner Thomas Rinn. “To stop this downward spiral in European industry, Europe needs to intelligently apply the latest developments in the digital world to its production processes. This would improve efficiency and competitiveness in the industry and boost Europe‘s share in global industry production.”

Industry 4.0: The European revolution

Using digital systems, companies will link their machines, storage systems and operating assets through global networks. The ongoing sharing of information around the clock and around the globe will enable these interconnected systems to independently manage themselves, work more efficiently and quickly identify any errors. In order to achieve this, companies must be able to transmit large volumes of data via capable IT infrastructure. “The good news is that Europe is much better prepared for the Industry 4.0 revolution than one might think,” says Blanchet. “But successful revitalization of European industry depends on whether business and politics can develop a common agenda.” With annual investments of around € 90 billion over the next 15 years, Europe should be able to position itself as a trailblazer in this new industrial world.

Pan-European commitment is required

To promote this process, important actions are necessary at the European level – first and foremost a common legal framework for all countries in Europe. “As soon as the general framework for enabling the digitalization of industry exists, companies in the individual countries will be much more willing to invest,” says Rinn.

Europe also needs a more harmonized IT infrastructure, sustainable financing plans and appropriate training facilities in areas such as software programming or gathering and evaluating data. This is because as Industry 4.0 develops, new experts who understand these networked industrial processes will be required in various industry areas. “Targeted partnerships between different industries, which often involve several countries, will play an important role in using digitalization expertise more efficiently,” forecasts Blanchet.

This is where politics needs to support the process by initiating research and development programs at the European level. This will promote long-term research projects and innovation development. And this is an important aspect to consider when aiming to strengthen European industry‘s leadership position in the global market. Shorter and shorter product lifecycles are forcing industry to innovate at an ever-faster pace to maintain a competitive edge.

However, it is not only politics that needs to help pave the way for Industry 4.0. Every company is well-advised to challenge its production strategy to optimally seize the new digital opportunities offered by interconnectivity. “Companies can do this in a number of different ways,” recommends Rinn. “By modernizing their existing factories or investing in new production facilities and innovative IT systems, companies can improve productivity in Europe and contribute to European re-industrialization.”

The study can be ordered free of charge at: www.rolandberger.de/pressemitteilungen