Latest market trends for FGD gypsum

Will we run out of FGD gypsum in the future? This question is more frequently asked because of the phase-out of coal-fired power plants due to the decarbonisation of the power industry. Here, a deep insight is given into the latest development of the power plant industry and how FGD gypsum production and utilisation will change in the most important regional markets. Furthermore, latest projections are presented about the FGD gypsum demand from the wallboard industry, cement industry and other gypsum industries.

1 Introduction

Flue-gas desulphurisation (FGD) systems have been used to limit the emissions of sulphur dioxide (SO2) from coal-fired power plants since the late 1960s. The first large scale systems were installed in North America, Europe and Japan, due to the growing concern about acid rain in these areas of the world. Acid rain can have very negative effects on plants, trees, fish and wildlife. The lower the pH of surface waters, the higher the effect, meaning that the effect doubles with each digit below a pH of 6. In Europe for instance, the emissions of SO2 from the burning of fossil fuels increased from about 25 million t per year (Mt/a) in 1950 to 40 Mt/a in 1960. In 1980 the SO2 emissions peaked in Europe with more than 61 Mt/a. Today, the emissions are almost back to 10 Mt/a, which was the level in Europe at the end of the 19th century.

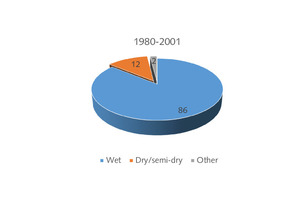

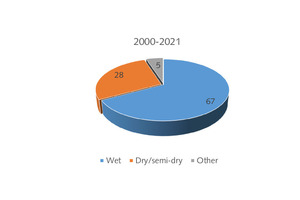

The market for FGD systems was rapidly growing for utility boilers (power plants) as well as non-utility industrial boilers. Figure 1 shows how the main FGD technologies for power plants have developed from 1980 to 2021. There are many different systems on the market [1], but they can be categorized into just three basic systems. The market is still dominated by wet FGD systems, which are also referred to as limestone forced oxidisation units, with 86% from 1980 to 2001 and 57% from 2000 to 2021, related to the generating capacity of power plants installed since 1980. However, in the last few years dry and semi-dry systems have been increasingly installed together with CFB (circulated fluid-bed) boilers. Especially with advanced CFB boilers, these systems are installed for capacities of up to 500 MW and sulphur contents up to 4%, which were previously a domain of the wet FGD systems. Another trend is for seawater FGD systems, which require no additives and have much lower installation and operating costs.

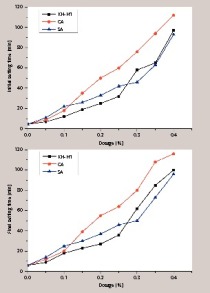

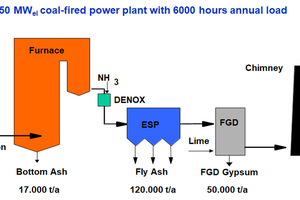

In the wet limestone FGD process a limestone slurry (CaSO3) is used to remove SO2 from the boiler flue gases. A typical 450 MW hard coal-fired power plant (Figure 2) using imported coal with 0.8% sulphur generates more than 50000 t/a of FGD gypsum in 6000 h (annual operation below full load). Different kinds of scrubbers and absorbers can be used to achieve a SO2 removal of up to 99%. The solids produced by FGD systems represent the second largest coal combustion product (CCP) stream by volume, only exceeded by fly ash from the combustion process. The wet product from a limestone-based reagent or absorbent is called FGD gypsum and is predominantly calcium sulphate dihydrate (CaSO4∙2H2O), which has about the same qualities as natural gypsum, or better. FGD gypsum can be used in the production of wallboard, plasterboard and other gypsum building products, as a retarder in the cement industry or as a soil stabilizer in the agricultural industry.

2 Market development of the power plant sector

Here we will concentrate on the power plant (utility) industry, which includes hard coal and lignite-fired power plants (Figure 3), although wet FGD systems are also operated in several other industries, such as the chemical & petrochemical industry, paper, steel, waste-to-energy and others to produce steam in industrial boilers, because utilities account for an estimated share of more than 80% of the wet FGD systems by boiler capacity.

2.1 Latest market development

According to the International Energy Agency (IEA), global coal-fired power generation is set to reach an all-time high in 2021 with an increase by 9% to 10350 terrawatt hours [2]. The largest gains of almost 20% have been in the United States and the European Union, where shares of coal in the power generation have been declining for years. Rising gas prices were the main reason for a significant switching back to coal. India and China achieved growth rates of 12% and 9% in coal-fired power. In total, coal’s share in the global power-mix has declined to 36%, which is 7% lower than its peak in 2007. However, as coal is still the cornerstone of the electricity supplies of India, China and some Southeast Asian countries, it is estimated that coal-fired power generation will increase during 2021-2024 by about 4.1% in China, 11% in India and 12% in Southeast Asia.

There are still many go-aheads for new coal-fired power projects around the world. In China, the government has lowered restrictions on building new plants, allowing for greater construction approvals in more provinces. Final investment decisions for coal-fired power plants have also gained speed in Indonesia, Cambodia and Pakistan, with these three countries together approving almost 5 Gigawatt (GW) of new coal capacity. In India, the approved amount has dropped below 1 GW, its lowest level in a decade. Forecasts by the IEA and other energy agencies come to the conclusion that global coal-fired power generating capacities will increase in the currently stated policy scenarios from 7484 GW in 2019 to between 13420 and 16550 GW by 2040. These scenarios already take into account that almost all coal-fired power plants in Europe and most of them in the USA will be phased out by 2040. However, there is still a long way to go. Europe is halfway towards closing all coal-fired power plants, while some countries have not made a commitment yet.

2.2 Market drivers for FGD process decisions

The decarbonisation efforts and the coal exit plans to achieve the Paris Climate Agreement on greenhouse gas emissions are one of the largest market drivers. Furthermore, emission limits for conventional pollutants from power plants, including NOx, SO2 and particulate matter, continue to tighten around the globe. E.g. in India new stringent emission norms came into force in 2015. All power plants installed after 2017 have to comply with the SO2 norm of max. 100 mg/Nm3. Before that date power plants with <500 MW had an allowance of 600 mg/Nm3 and those ≥ 500 MW had an allowance of 200 mg/Nm3.

In the past, wet FGD systems were the most popular choice for large boilers due to their very high SO2 removal rates over a wide range of coal sulphur levels. Low-cost limestone could be used as a reagent and the generated FGD gypsum could be sold in the local market. However, on the downside, wet FGD systems are expensive to build and they need a significant amount of the produced electricity for their own operation. Therefore, alternative CFB scrubbing technologies are growing in popularity due to their much lower capital costs and lower water consumption. While their domain some time ago was power plants with less than 300 MW and low coal sulphur content, today, CFB technology is already applied for units up to 700 MW and fuels with sulphur levels higher than 3%. Another argument is that these systems also allow for a capture of mercury, acid gases and dioxins in addition to SO2 and particulates. This is most evident in the latest U.S. retrofit projects in the pipeline, where more and more units will use CFB technology, despite the high deposit costs for FGD waste products.

When looking particularly to Europe, there is still a small market for FGD systems (new plants and retrofits) due to Best Available Technology (BAT) conclusions, which entered into force in 2021 and which will include stricter SO2 emission parameters (10-130 mg SO2/Nm3 for existing conventional boilers >300 MW and 20-180 for existing fluidized bed boilers >300 MW) and for NOX and particulate matter. The lower values can only be achieved with wet FGD systems. There are many units that will be upgraded, e.g. Opole 1-3 in Poland, Ugljevik in Bosnia-Herzegovina, Rovinari in Romania. Furthermore, in the last few years, new coal-fired power plants have been installed in Poland (2x900 MW in Opole, 1x 490 MW, Turow 7), Czech Republic (1x660 MW, Ledvice), Germany (1x1100 MW, Datteln 4). Other planned new coal-fired power plants such as the 1x500 MW Plomin C in Croatia or the 1x450 MW Meliti II in Greece have been stopped.

3 FGD gypsum production and utilisation, worldwide

3.1 Germany and Europe

In Germany the phase-out of coal-fired power was accelerated with the first auctioning for the decommissioning of hard-coal plants. 11 more plants with a generating capacity of almost 5 GW are out of the market since June 2021. These plants include Moorburg 2x800 MW, Westfalia Block E with 1x800 MW, Ibbenbüren 1x800 MW and Heyden 4 with 1x875 MW, although some of these plants might be used as a capacity reserve. However, the decision has also been criticized, because Westfalen came on line in 2014 and Moorburg in 2015 and were thus two of the most modern power plants in Europe, while some much older power plants with high CO2 footprint and high emission rates will continue to operate for many years. Anyhow, the closure of these power plants has a huge impact on the generation of FGD gypsum.

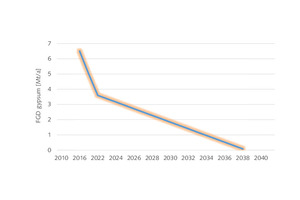

Figure 4 shows a prognosis by the German “Bundesverband der Deutschen Gipsindustrie” for the generated FGD gypsum up to the 2040, under the commitment of the former German Government to phase-out all coal fired power plants by 2038. Germany’s new coalition government reached a major agreement concerning the nation’s future energy plans, including an accelerated 2030 coal phase-out target, along with plans to have 80% of the country’s electricity generated from renewable energy sources by the same year. Accordingly, it can be suggested that after 2030 limited FGD gypsum tonnages will be generated only in industrial boilers and waste-to-energy plants. Some wallboard plants such as the Rigips factory in Scholven invested already in 2017 in a gypsum recycling plant (Figure 5), after the closure of the adjacent 2x435 MW Uniper coal-fired power plant has been announced. Over the last two decades Germany has always been by far the largest contributor to the EU FGD gypsum production. From now on the no. 1 position will probably be taken over by Poland.

According to the European Coal Combustion Products Association (ECOBA) more than 18 Mt/a of gypsum related products were generated in 2019 by the power plants in the EU28 countries [3]. This includes FGD gypsum as well as semi-dry adsorption products. Exact figures for FGD gypsum exist for the EU 15 countries (Western Europe without Eastern Europe). Figure 6 shows the development in the production of FGD gypsum in the EU15 for three years in the period 2008 to 2019 according to the major utilisation. In 2008 about 11.25 Mt/a were still produced, while in 2019 the production fell to 6.99 Mt/a. The utilisation rates increased from 71.5% in 2017 to 79.3% in 2019 and it is expected that they will increase to more than 95% when logistical problems have been solved. Nevertheless, there are still relatively large quantities which are either sent to reclamation sites (mono disposal without mixing the FGD gypsum with other products), stockpiles for later use and FGD gypsum disposal with other products, such as ash.

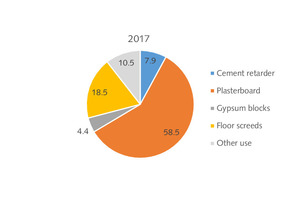

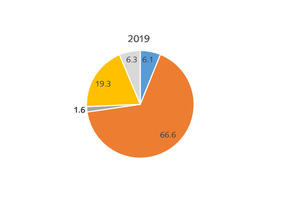

Figure 7 shows how the utilised FGD gypsum has been used in the EU15 in recent years. In absolute figures, 7.44 Mt/a FGD gypsum were used in 2017 and 5.56 Mt/a in 2019. Most of the FGD gypsum was used for the production of plasterboard (wallboard) with 58.5% in 2017 and 66.6% in 2019. Floor screeds increased their share from 18.5% to 19.3%, while all other uses lost market shares. FGD gypsum as a cement retarder had a market share of only 6.1% in 2019. In absolute figures, the quantities for the cement application declined from 0.589 Mt/a in 2017 to 0.341 Mt/a in 2019. Moreover, the quantities for plasterboard also declined from 4.356 Mt/a to 3.718 Mt/a. This means that with a slightly increasing gypsum production in Europe (Germany alone required 10 Mt/a raw gypsum) the gap from the declining FGD gypsum production has to be closed, either by a higher production of natural gypsum, higher recycling rates for plasterboard and other gypsum products, higher FGD gypsum imports, reclamation of FGD gypsum from deposits or a mix of these.

3.2 United States

In 2021, 212 GW of coal-fired electric generating capacity was operating in the United States utilities, most of which was built in the 1970s and 1980s. Although the coal-fired power plants have no mandatory retirement age, power plant owners and operators have reported to the Energy Information Agency (EIA) that they currently plan to retire 28%, or 59 GW, of the coal-fired capacity by 2035. As a result of continued pressure on coal generation to reduce CO2 emissions, the number of coal plants planned to retire between now and 2035 is likely to increase. There are more than 32 GW of new gas-fired power plants in the pipeline in the USA, but almost no new coal-fired power plants. Accordingly, the quantities of FGD gypsum from power plants are forecast to decline. This will also affect those plasterboard plants which were installed in the vicinity of power plants (Figure 8).

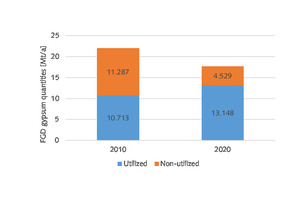

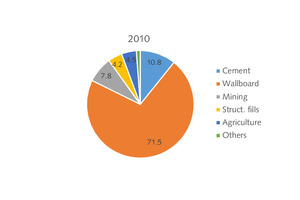

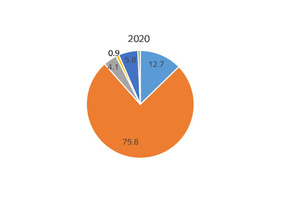

The generated FGD gypsum quantities in the USA decreased from 22.0 Mt/a in 2010 to 17.68 Mt/a in 2020 (Figure 9). However, the utilisation increased from 48.7% to 74.4% in this period. Utilisation of the FGD gypsum for wallboard production dominates the applications with almost 76% or 9.963 Mt/a (Figure 10). These quantities probably also include small amounts of gypsum for other panel products. Floor screeds or other gypsum products are not shown in the statistics. The 12.7% share of FGD gypsum for the cement industry is more than twice as high as in the EU15 countries. Interestingly, more than 10% of the (high quality) FGD gypsum is still used in applications such as mining, structural fills and agriculture, which could also use lower quality gypsum.

3.3 China and India

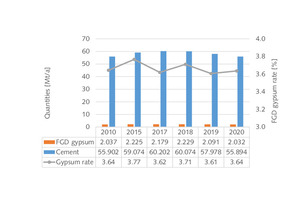

According to the Helsinki-based Centre for Research on Energy and Clean Air (CREA), about 15 GW of China’s new coal power capacity started construction in the first half of 2021 and 24 GW of new projects were announced or re-activated. The volume of new projects represents a return to pre-Covid levels after they surged in 2020, but still amounts to almost one new coal power plant per week. To promote FGD system installations, the Chinese government has implemented a series of policies, e.g., an on-grid tariff premium and operational priority for power plants with scrubbers. With the supporting policies and technological improvement in scrubbers, the proportion of coal power plants equipped with scrubbers increased from 12% in 2005 to 83% in 2010 and further to 99% by the end of 2015. Now China has surpassed all other countries in terms of flue gas desulfurization (FGD) systems. Figure 11 shows how the FGD gypsum quantities have increased over time [4]. About 65% is utilized by the cement and gypsum industries.

In India, gypsum is a scarce resource. The country’s gypsum consumption in FY 2019/20 was around 13 Mt/a, out of which it only produced 2.5 Mt/a, while importing the rest. Accordingly, the cement and gypsum industries greatly welcome the fact that a large number of coal-fired power plants are set to install FGD systems by 2022 or later in order to meet the new emission norms announced by the government in 2015. Accordingly, this leads to a large retrofitting of FGD systems in India. According to India’s Central Electricity Authority (CEA), new FGD systems have been planned for 415 coal-fired boilers with a capacity of about 160 GW out of the total of 650 units with a capacity of almost 200 GW. At the moment, 60 GW of NTPC capacity is underway for the installation of such systems. Conservative estimates indicate that about 6-7 Mt/a of FGD gypsum can be generated in the near future, up from almost zero.

3.4 Rest of the world

In 2020, Japan announced its intention to phase out its less-efficient coal-fired power plants by 2030. Of the 140 coal-fired power plants in operation, more than two-thirds (representing about 50% of installed coal capacity) will be retired. Around 5 GW of new ultra-supercritical and integrated gasification combined cycle plants will replace some of the retired capacity. However, at least in the cement industry there is no sign of declining FGD gypsum rates up to now (Figure 12).

In Australia, coal-fired power dominates the power generation with about 23 GW or 54%. Currently, there are 24 coal-fired power plants. However, 14 GW of coal-fired power are planned to be withdrawn by 2030 and coal will have entirely exited the electricity market by 2043. Up to now, wet FGD systems have played no role in Australia. AGL Energy, which is the top utility in Australia with 10.98 GW, announced that the Liddell coal-fired station will be closed by 2023, while probably the Bayswater and Long Yang A power plants will be equipped with FGD systems to reduce SO2 emissions by about 99%.

In South Africa, wet FGD systems have also played no role up to now. State-owned Eskom operates 30 power plants with an operational capacity of 41 GW, of which 37.4 GW are coal-fired (Figure 13). Kusile is the latest “six pack” power plant addition with 6x800 MW. However, Kusile is also the first coal-fired power plant in South Africa with a wet desulphurisation system. Blocks 1-4 have already been in operation since December 2021, while blocks 5-6 will come on line within the next year. Eskom is fitting the power plant with state-of-the-art wet FGD systems, which will generate about 0.5 Mt/a of FGD gypsum when fully operational.

4 Future FGD demand

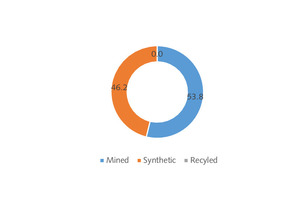

Worldwide, a total amount of 310.8 Mt/a of gypsum was used by the different industries in 2019. The cement industry accounts for about 53% of the global consumption while the wallboard industry accounts for about 29% [5]. For 2025 and 2030 a consumption of 318.3 Mt/a and 337.9 Mt/a has been forecasted, respectively. While uncalcined gypsum will slightly decline from 2019 to 2030, calcined gypsum will significantly increase from about 130 Mt/a in 2019 to more than 164 Mt/a by 2030. Calcined gypsum is necessary for wallboard products, gypsum blocks and panels and plaster products. Uncalcined gypsum is used in the cement industry and other applications (agriculture, etc.). Due to the depletion of natural gypsum in a number of countries, the demand for synthetic gypsum will increase, despite the lower production of FGD gypsum in some established markets.

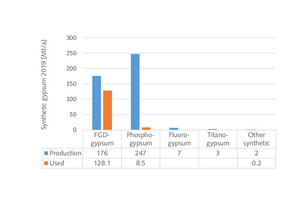

The global production of synthetic gypsum exceeds the output of mined gypsum. There are basically 5 different types of synthetic gypsum (Figure 14). In 2019, the generated quantity of phosphogypsum, which is a by-product from the processing of phosphoric acid, was about 247 Mt/a. This is followed by FGD gypsum with about 176 Mt/a. In recent years this figure has mainly increased because of the growing generation capacities in China. All other synthetic gypsum types such as fluorogypsum, titanogypsum and marine gypsum play no major role. Of the total 495 Mt/a of synthetic gypsum, only 136.8 Mt/a (31.4%) have been used. The largest quantity comes from FGD gypsum with 128.1 Mt/a, or 72.8% of the synthetic gypsum on a global scale. Only 8.5 Mt/a or 3.4% of the phosphogypsum has been used and only 0.2 Mt/a or 10% of the other synthetic gypsum types. In the last few years especially the use of phosphogypsum has improved, because of the global availability and advances in the processing of this type of gypsum.

4.1 Wallboard industry

Figure 15 shows the projected global gypsum demand of the wallboard industry. The demand is projected to grow from 89.0 Mt/a in 2019 to 99.5 Mt/a in 2025 and 112.6 Mt/a by 2030. In the Covid 19 year 2020 the demand declined by about 3.9%, while in 2021 the recovery was 3.2%. For the years to come the projected global growth rates are between 2.5 and 3.1%. In 2019 the majority of the gypsum for the wallboard industry was synthetic gypsum with already 53.0%, which corresponds to 47.2 Mt/a (Figure 16). More than 97% was FGD gypsum. Even with increasing FGD gypsum quantities in Asia, demand by the wallboard industry in the Americas and Europe, which will account for almost half of the wallboard production, cannot be fulfilled. Accordingly, either more natural gypsum has to be mined, FGD gypsum has to be reclaimed, imported, or other synthetic gypsum products will have to be used.

4.2 Cement industry

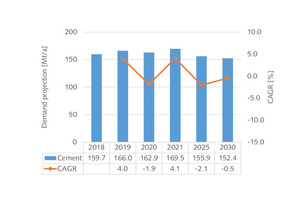

The future global demand for gypsum in the cement industry will depend very much on the development in China, where the cement demand is projected to peak before 2025. Accordingly, the gypsum demand of the cement industry is projected to decline (Figure 17). However, in 2020 the decline because of Covid 19 was much lower than expected and in 2021 there was a recovery of about 4.1%. Due to the growing share of blended cements, the average global gypsum rate in cement is projected to decline from 3.97% in 2019 to 3.88% by 2030. Figure 18 shows that in 2019 already 46.2% of the gypsum used in the cement industry was synthetic gypsum. Almost 7.1 Mt/a of this synthetic gypsum, or 8.1%, is phosphogypsum and 91.8% is FGD gypsum. It can be expected that the quantities of phosphogypsum in the cement industry will increase further, so that deficiencies with FGD gypsum can be balanced out.

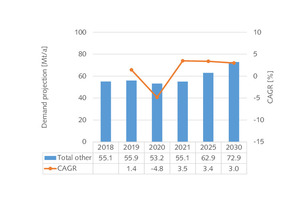

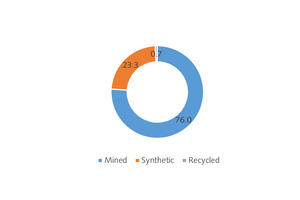

4.3 Other industries

The global gypsum demand for use in other gypsum products, such as gypsum panels, blocks, plaster and floor screed is projected to increase from 55.9 Mt/a in 2019 to 72.9 Mt/a by 2030 (Figure 19). In 2020 there was a major decline by about -4.8%, mostly because of smaller production due to a lockdown of construction sites. However, already in 2021 the recovery was 3.5% and also for the next few years growth rates in the range of 3.0 to 3.4% are projected. The share of synthetic gypsum in the demand in 2019 was 23.3% or 13.0 Mt/a, of which 12.0 Mt/a or 92.3% are FGD gypsum (Figure 20). In this market segment it can also be expected that lower FDG gypsum quantities can be relatively easily balanced out by other synthetic gypsums.

5 Market outlook

Globally, in 2019 about 176 Mt/a of FGD gypsum were generated by power plants, of which 128.1 Mt/a or 72.8% have been used. It is expected that the global generation of FGD gypsum will peak around 2030, when e.g. in Europe only small quantities of generated FGD gypsum will still be available. Europe, Japan and probably the USA will be the first countries/regions, where FGD gypsum will become rare. Accordingly, the utilisation has to change so that quality FGD gypsum will be used in wallboard production, while other industries will increasingly have to use other sources such as phosphogypsum. Also, more recycled gypsum will come onto the markets and in some cases FGD gypsum from mono-deposits could also be reclaimed.

![11 FGD gypsum quantities in China [4]](/uploads/images/2022/w300_h200_x421_y297_Markets_Harder_FGD_gypsum_11n-657ce814488b3c2a.jpeg)