Latest trends in Africa’s cement industry

The cement industry in Africa developed mostly positively in 2020 despite the Covid-19 pandemic, especially south of the Sahara. However, due to the high rates of population increase, especially in Central Africa, the per capita cement consumption significantly declined in many countries. This market review comprises the most important market information about the development of the main cement markets in Africa and the main cement producers in this world area.

1 Introduction

In Africa, measures by the governments to stabilize and support their economies during the Covid-19 pandemic have been insignificant when compared with the stimulus programs in the major Western countries. Surprisingly, up to now most of the African countries have had a much better economic performance than other countries around the world. According to the International Monetary Fund’s (IMF) latest World Economic Outlook, the GDP in sub-Saharan Africa decreased from 3.2% in 2019 to -1.8% in 2020. South Africa and Zambia were hit the hardest. For the years 2021 and 2022 for sub-Saharan Africa a recovery of 3.4% and 4.1% is projected. The growth is supported mainly by improved exports and commodity prices, along with a recovery in private consumption and investment in the construction and mining sectors.

According to the World Population Reference Bureau, in mid-2020 Africa had a population of about 1.338 billion people. The urban population is 43%, with 16% living in cities of 1 million and more. Africa has a 2.6% rate of natural population increase. Accordingly, the population is projected to increase to 1.887 billion in 2035 and 2.560 billion in 2050. This means the population is projected to grow by 91%, accounting for almost 60% of the projected worldwide population growth by 2050. Population growth varies substantially across the continent, ranging from only 28% in Southern Africa to almost 130% in Central Africa. The average household size is 4.7 people and the gross national income per capita is US$ 4820 (2020). 41% of the population is below 15 years old, which provides an opportunity for accelerated economic growth, according to the World Bank and other sources.

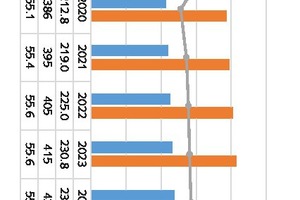

In our African Market Review 2014 [1], the per capita cement consumption (PCC) in North Africa was 553 kg while it was only 102 kg in sub-Saharan Africa. In 2014 the North, with 98.2 million t per year (Mt/a), also produced more than the Rest of Africa, which achieved 85.2 Mt/a (46.5%). Looking seven years later, the situation has significantly changed. In 2020 the PCC has declined to 435 kg in North Africa, while in sub-Saharan Africa the PCC has slightly increased to 113 kg. 91.8 Mt/a or only 43.1% are produced in the North, while 121.0 Mt/a or 56.9% are produced in sub-Saharan Africa. The cement capacity in Africa has significantly increased from 262.0 Mt/a in 2014 to 386.1 Mt/a, which is an increase of 124.1 Mt/a. Accordingly, the cement capacity utilisation in Africa has decreased from 70.0% in 2014 to 55.1% in 2020, but is projected to increase in the next few years.

2 Largest African cement producing countries

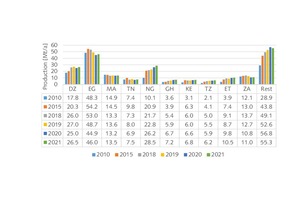

The demand for cement and other building materials in Africa, particularly south of the Sahara, continued mostly to develop positively in 2020 despite Covid-19. Figure 1 shows the Top 10 cement producing countries in Africa in 2020. The Top 10 account for 73.3% of the cement production and 73.8% of the cement capacity in Africa in 2020 and are home to 53.7% of the population. The other 33 cement producing countries in Africa only account for 26.7% of the production and 26.2% of the capacity but for 46.3% of the population. This review starts in North Africa and ends in South Africa.

2.1 Algeria (DZ)

In 2020 Algeria had a population of 44.4 million. With a cement consumption of 23.1 Mt/a the PCC stood at 522 kg, which is the highest figure of all countries in Africa. There are 2 major cement producers in the country and four smaller ones. The largest are Groupe Industriel des Ciments d’Algérie (GICA) and Holcim. Figure 2 shows how GICA has developed in the last few years. In 2020, the cement capacity in the country stood at 40.6 Mt/a; 25.0 Mt/a were produced of which 1.9 Mt/a (cement and clinker) were exported. The capacity utilisation was 61.6%, which is one of the highest in Africa. For 2021 a moderate increase in cement production to 26.5 Mt/a is projected, corresponding to a CAGR of 6.0%.

2.2 Egypt (EG)

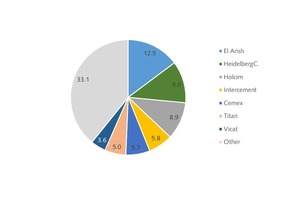

In Egypt the cement industry is under pressure. In 2020 only 44.9 Mt/a of cement were produced after 48.7 Mt/a in 2019. With a population of 100.8 million, the PCC has fallen to 425 kg, after much higher figures years before. With a cement capacity of 84.5 Mt/a the capacity utilisation only stands at 53.1%. Egypt has 16 cement producers. The largest are El Arish Cement, Suez Cement (HeidelbergCement), Lafarge Egypt (Holcim), Assuit Cement (Cemex), Amreyah Cement (Intercement), Beni Suef Cement (Titan Group), Arabian Cement and Sinai Cement (Vicat) (Figure 3). The El Arish cement plant with six production lines, each with 6000 t/d is the largest cement plant ever built. For 2021, a production increase in Egypt by 2.4% is projected.

2.3 Morocco (MA)

Morocco has a population of 36.0 million. In the last few years, the country could not fulfil the high expectations of the cement industry and analysts. In 2020 cement sales declined by 10.0%, with highest losses in the Marrakesch-Safi region and in Casablanca-Settat. Cement consumption was 12.3 Mt/a, corresponding to a PCC of 342 kg. With a modern cement capacity (Figure 4) of 21.5 Mt/a, the capacity utilisation stands at 61.6%. The largest producers are Lafarge Maroc, which is a 50/50 partnership between the Lafarge Group and SNI/ONA (Société Nationale d‘Investissement), Ciments du Maroc (HeidelbergCement), Ciments de l’Atlas (CIMAT) and Votorantim.

2.4 Tunisia (TN)

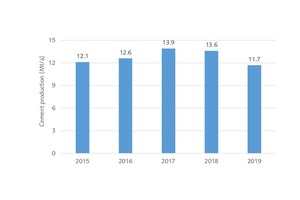

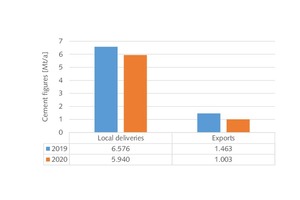

At the moment, Tunisia is facing political and economic turmoil. The country, which has only 11.9 million inhabitants, faces its biggest crisis since the 2011 spring revolution. The cement consumption was 5.94 Mt/a in 2020 (Figure 5), leading to a per capita consumption of 499 kg. With 31.4% lower exports, only 6.9 Mt/a of cement were produced after 8.0 Mt/a in 2019. With 12.5 Mt/a operational cement capacity, the capacity utilisation was 55.5%. Nine cement producers operate nine cement plants. Carthage Cement, Ciments d’Enfidha (Grupo Cementos Portland Valderrivas), Ciments Jbel Oust (Votorantim Cimentos) and Ciments de Bizerte have the largest capacities. For the year 2021, the cement production is expected to recover.

2.5 Nigeria (NG)

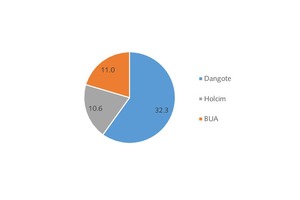

The cement market in Nigeria is booming. In the pandemic year the cement production increased by 14.9% to 26.2 Mt/a, of which 0.18 Mt/a were exported. However, with a population of 206.1 million and a cement consumption of 26.0 Mt/a, the PCC is only 126 kg. With just 48.3%, Nigeria has the lowest cement capacity utilisation, resulting from a cement capacity of 53.5 Mt/a. With Dangote, Lafarge Nigeria (Holcim) and BUA Cement, there are only three cement producers in the country. BUA resulted from a merger of CCCN and Obu Cement in January 2020. Figure 6 shows the market shares in Nigeria by cement capacity. However, it has already been announced that much more cement capacity will be installed in the next few years.

2.6 Ghana (GH)

Ghana has a population of 31.1 million. The +1.1% GDP growth in 2020 is a steep fall from the pre-Covid-19 levels of 6.5%. However, the cement industry was unaffected and production rose to 6.7 Mt/a, after 5.9 Mt/a in 2019. With a PCC of 215 kg the country has the highest rate in sub-Saharan Africa. Ghana has six cement producers with a combined cement capacity of 10.6 Mt/a, which is completely generated by grinding plants (Figure 7), because the country has no limestone resources. The largest producers are Ghacem (HeidelbergCement Group), WACEM, Dangote and Ciments d’Afrique (CIMAF). Ghana is the largest clinker importer in Africa, while cement imports are relatively small.

2.7 Kenya (KE)

Kenya has a population of 53.5 million. Over the last ten years, Kenya has introduced important reforms to transform the country into “a newly industrialising, middle-income country” by the year 2030. Cement production increased from 5.97 Mt/a in 2019 to 6.55 Mt/a in 2020 (Figure 8). The PCC stands at 147 kg. A cement capacity of 11.3 Mt/a results in a capacity utilisation rate of 58.0%, which is above the African average. The largest producers are Bamburi Cement (Lafarge Kenya, member of Holcim), National Cement (Devki Group), Savannah Cement, Mombosa Cement and East African Portland Cement (EAPCC). National Cement recently acquired the ARM and Cemtech Sanghi assets in Kenya, which made the company the country’s No. 2 in cement.

2.8 Tanzania (TZ)

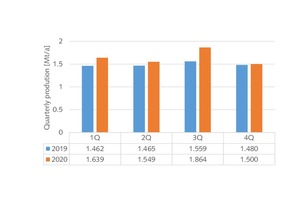

Tanzania has a population of 59.3 million, which is almost as big as the population of Italy. In July 2020, the country formally graduated from low-income status to lower-middle-income country status. In 2020 cement production increased slightly from 5.5 Mt/a to 5.9 Mt/a. With a cement consumption of 5.6 Mt/a the PCC increased to 94 kg. Tanzania has six integrated cement plants and seven grinding plants with a combined cement capacity of 11.0 Mt/a. Accordingly, the capacity utilisation was only 53.6%. The largest cement producers are Dangote (Figure 9), Tanzania Portland Cement (HeidelbergCement Group), Huaxin Cement (after its takeover of ARM Cement), Tanga Cement (Afrisam) and Lafarge Tanzania (Holcim). The Tanzania Investment Centre (TIC) has supplied Sinoma and Hengya Cement with a permit to begin construction of the company’s US$ 1 billion greenfield cement plant in Tanga region.

2.9 Ethiopia (ET)

Ethiopia has a population of almost 115 million, but there are growing concerns for its unity as the Tigray conflict spreads. Cement production increased from 8.7 Mt/a in 2019 to 9.8 Mt/a in 2020, but the PCC of 84 kg still relatively low and the cement capacity utilisation rate is only 49.7%. There are 15 cement producers with an estimated combined capacity of 19.7 Mt/a in 2020. The largest producers are Derba Midroc Cement (Figure 10), Dangote, Mugher Cement, Messebo Cement, Habesha Cement and National Cement. For many years now, the cement industry has been affected by cuts in the power supply and by difficulties in the spare parts supply [2]. Some smaller cement plants still use the vertical kiln technology.

2.10 South Africa (ZA)

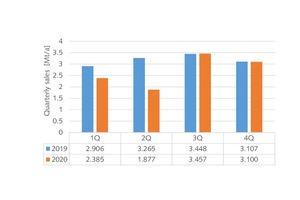

South Africa has a population of 59.6 million, equal to that of Tanzania. Its economic growth in the years 2018 and 2019 was only slightly above the zero mark. In 2020 the economy shrank by -7.0% and Moody’s downgraded South Africa’s sovereign credit rating to “junk” status. Cement production has been in decline for several years. In 2020 only 10.8 Mt/a were produced (Figure 11) after 13.76 Mt/a in 2018, which corresponds to a PCC of 180 kg. There are six cement producers with a combined cement capacity of 19.5 Mt/a, leading to a cement capacity utilisation of 55.4%. The largest producers are Pretoria Portland Cement (PPC), Afrisam, Lafarge South Africa (Holcim), Sephaku Cement (Dangote) and Intercement. Mamba Cement is the newest entrant into the market with a 1.2 Mt/a integrated plant, owned by Tangshan Jidong Cement.

3 Largest cement producers in Africa

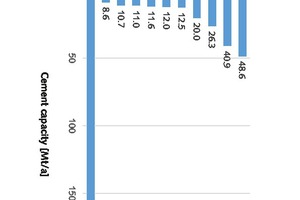

At the end of 2020 Africa’s cement industry had a cement capacity of 386.1 Mt/a. The Top 10 companies account for 202.2 Mt/a or 52.4% of the capacity (Figure 12). There are more than 50 other suppliers which combine 183.9 Mt/a or 47.6% of the capacity, which shows that the cement industry in Africa is still very fragmented. The influence of the foreign cement producers has become smaller and smaller in the last few years. Within the Top 10 only Holcim, HeidelbergCement, Intercement and Vicat have their headquarters outside Africa and are responsible for only 86.6 Mt/a or 22.4% of Africa’s cement capacity. Other foreign producers include Cemex, Votorantim, Titan Cement, Cementos Molins, Cementos Portland Valderrivas, Secil, Medcem and last but not least Huaxin and Tangshan Jidong Cement and other smaller Chinese producers.

3.1 Top 10 players

Dangote Cement

Nigerian-based Dangote has become the largest cement producer in Africa. The company has a total cement capacity of 48.6 Mt/a across Africa, of which 32.3 Mt/a alone are installed in Nigeria and 16.3 Mt/a in nine other countries including Tanzania, South Africa, Ethiopia, Cameroon, Rep. Congo, Ghana, Senegal, Zambia and Sierra Leone. The company started as a trading business with the import of bagged cement and bulk cement, which was bagged in the import terminals. Later in the 1990s Benue Cement and Obajana Cement were acquired, before the first new cement plant was installed in Obajana in 2007. Obajana now has a cement capacity of 16.25 Mt/a, making it the largest plant in Africa (Figure 13). The Ibese cement plant in Nigeria is Dangote’s second largest plant. The goal is to export clinker from these plants to the company’s own grinding plants in neighbouring countries in West and Central Africa.

Holcim Group

In July 2021 the Group name Lafarge-Holcim was changed to Holcim. Holcim Group is now synonymous with trusted brands such as ACC, Aggregate Industries, Ambuja Cements and Lafarge. In Africa, the company has a cement capacity of 40.9 Mt/a in 16 countries and of 61.4 Mt/a when the joint ventures in Morocco, Ivory Coast, Cameroon, Guinea and Benin are included. Holcim is the market leader in Kenya (Figure 14). However, their largest capacities are in Morocco, Algeria, Nigeria and Egypt. In 2007, Holcim completed the sale of 85% of its 54% stake in Holcim South Africa to AfriSam Consortium. The divestments continue in 2021. In January 2021, it was decided to divest the Company’s 35% equity interest in CBI Ghana, a cement grinding operation located in the Port of Accra. China-based Huaxin Cement intends to spend US$ 150 million on purchasing a 75% stake in Lafarge Zambia and US$ 10 million on acquiring Pan African Cement from Lafarge Cement Malawi.

HeidelbergCement

Heidelberg entered the market in Africa through the acquisition of Scancem in 1999. Today the Group has 26.3 Mt/a cement capacity from integrated cement plants in Egypt, Morocco, DR Congo, Tanzania and Togo (Figure 15) and grinding plants in five other countries in West Africa, namely Ghana, Benin, Burkina Faso, Liberia and Sierra Leone, as well as one other in Mozambique. The company’s production sites in Africa are primarily located close to urban centres and are therefore well positioned to serve the growing cement demand. However, the majority participation in Suez Cement in Egypt was recently delisted from the stock exchange and 11.3% of the shares in Ciments du Maroc were sold. It cannot be excluded that due to the portfolio optimisation strategy of the company more African assets will be sold.

GICA, Algeria

The state-owned Groupe Industriel des Ciments d’Algerie (GICA) comprises 14 subsidiaries with a combined cement capacity of 20 Mt/a. The Group was created on 26 November 2009 by combining the state-owned Algerian cement and building material companies. Today, each cement company works independently and publishes its own economic reports and balance sheets. In five companies a second investor holds a minority stake, including BuzziUnicem and Saudi Pharaon Group. Except for the Bechar cement plant (Figure 16), all other plants are in proximity to the coast, which offers excellent export opportunities. The largest plants are those in Chlef, Setif (Ain El Kebira) and Sigus (Oum El Bouaghi), each one with 6000 t/d clinker capacity and more than 2 Mt/a cement capacity.

El Arish, Egypt

The Egyptian Armed Forces are the owners of the Al-Arish plant in Beni Suef, Egypt. The plant comprises six identical kiln lines, each with 6000 t/p, and it is the biggest cement plant in the world to be built all at one time and in one place (Figure 17). The rated cement capacity is 12.5 Mt/a. The Beni Suef plant produced its first clinker in December 2017, when Egypt already had a large excess cement capacity. The Al-Arish plant reported that cement prices have fallen by 25 to 30% since the project was completed.

Addhoha Group, Morocco

The group was founded in 1988 by Anas Al-Sefrioui, a pioneer in real estate in Morocco. In 2007 Ciments de l’Atlas (CIMAT) was formed and the simultaneous construction of two cement plants with a capacity of 1.6 Mt/a was launched. Ciments d’Afrique (CIMAF) was created in 2011 with the objective of installing cement grinding plants in sub-Saharan Africa. The first plant was installed in the Ivory Coast and then more plants followed in Guinea, Cameroon, Burkina Faso, Gabon, Rep. Congo, Ghana, Mali and Mauretania. The grinding plant capacities are between 0.3 and 1.6 Mt/a. Most of the plants have a capacity of 0.5 Mt/a. The total cement capacity of the Addhoha Group is 12.0 Mt/a.

PPC, South Africa

Pretoria Portland Cement has a cement capacity of 11.6 Mt/a from seven integrated cement plants and seven grinding stations across the sub-Saharan countries South Africa (Figure 18), Ethiopia, Zimbabwe, DR Congo and Rwanda. In Ethiopia, the company has a 37.7% share in Habesha Cement. PPC has a world-class asset base and spent over US$ 750 million in the past five years on increasing their cement capacity. Beside the cement plants, PPC operates one lime plant (1.0 Mt/a) and two slag grinding plants (0.75 Mt/a). PPC states its cement capacity replacement value as R 36.0 billion at US$ 230 per annualised tonne.

BUA Group, Nigeria

BUA Cement is one of the most dynamic cement producers in Africa. The company was incorporated in 2008 and commenced operations in the same year through its floating cement terminals in Nigeria. In 2009, the BUA Group acquired the Cement Company of Northern Nigeria or CCNN (Sokoto Cement) and Edo Cement. Today, the company has a capacity of 11.0 Mt/a from its Kalambaina plant (Sokoto State) and Obu plant (Edo State). During 2020, it achieved a capacity utilisation above 60% with both plants. However, three new cement lines are under development.

Other two Top 10 companies

The other Top 10 cement producers in Africa are Intercement and Vicat. Intercement has 10.7 Mt/a cement capacity from its plants in Egypt (Amreyah Cement), Mozambique (Cimentos de Moçambique) and South Africa (Natal Portland Cement). In 2018 a cement grinding plant was acquired in Mozambique, bringing the company’s capacity in the country to 3.1 Mt/a. The Vicat Group, on the other hand, has cement production plants in Egypt, Senegal, Mali and Mauretania. With a cement capacity of 3.5 Mt/a, Sococim is the largest cement producer in Senegal.

4 Outlook

The outlook for the cement industry in Africa looks bright for the next few years (Figure 19). In our projection, the cement production will increase from 212.8 Mt/a in 2020 to about 244.1 Mt/a by 2025. The CAGR for cement production growth will range from 2.6 % at the lowest to 2.9% at the highest. Accordingly, with an average population growth of 2.6% in Africa, the per capita cement consumption will only slightly change. Cement capacity is projected to increase from 381 Mt/a in 2020 to 437 Mt/a by 2025. This corresponds to a CAGR in the cement capacity of 2.3% to 2.7%. With these figures, the cement capacity utilisation is projected to slightly increase from 55.1% to 55.9% by 2025. Accordingly, the cement prices will be mostly stable with a slight upward trend.