Latest trends in modular cement grinding plants

The cement industry is always looking for innovations and a quick return on the capital employed. One such opportunity is modular cement grinding plants. Various proven compact plant concepts are available on the market. In this article we will have a closer look into the technology and discuss the regional markets where it is used. Is there a typical type of investor for such modular cement grinding projects, what is the future outlook?

1 Introduction

In the last few years, investments in new clinker capacity have become rare. However, the capacity expansion of stand-alone grinding plants has never paused. Especially the demand for compact and modular cement grinding plants is in the trend. The technology was introduced to the market by the Spanish supplier Cemengal. The first two of these plants were ordered in 2012 for relatively low annual cement grinding capacities of 0.09 million tons per year (Mt/a). One of these investors is a ready mixed concrete supplier, which shows that this kind of modular cement grinding plant finds customers outside the established cement markets. The first two plants were equipped with relatively small and standardized single ball mills of 2.2 m diameter and 9.0 m length, which still fit the dimensions of 40 ft shipping containers. In today’s projects larger ball mills of 3.5 m diameter and 11.5 m length are used, which achieve capacities of up to 0.4 Mt/a.

Nowadays, as another option to ball mills, vertical roller mills (VRM) are used by most of the modular cement grinding plant suppliers. With these VRMs, depending on the mill size, much larger cement capacities can be achieved. However, in the compact sector maximum throughputs are more in the range of 75 t/h or 0.5 Mt/a, respectively for Ordinary Portland Cement. Modular grinding plants are also used for slag cements and all other types of blended cements. Anyhow, the throughputs for slag cement plants are smaller and depend to a larger extent on the required product fineness. The designs of modular ball mill and VRM plant concepts are very similar, but in detail they differ significantly. Both designs have their advantages and disadvantages. In principle, ball mill concepts have lower investment costs but higher operating and maintenance costs than VRM concepts. VRM concepts have the further advantage of having a higher flexibility in the grinding materials.

For investors, beside investment and operating costs, there are a number of reasons to further evaluate the idea of setting up a modular cement grinding plant. The main reasons are:

Short time to market, quick return of investment

Simple installation and commissioning, pre-assembled solution

New market entry, allowing access to local and remote markets

Gaining a market share where there is only one dominating player

Easy use of local sources of cementitious products

Suppliers also argue that the plants can easily be re-assembled and relocated to other locations. Up to now we have seen only one project where this option has been used.

2 The plant concepts and modules

The idea behind the “Plug & Grind” concept of Cemengal was to introduce a portable cement grinding system which is completely modularized and which fits into about eight Standard 40 ft containers (Figure 1). It should be easy to transport and to install by using pre-assembled equipment. Further advantages are that only relatively simple civil works are required for the installation and that operation and maintenance are made as easy as possible by using advanced plant automation control, so that for the plant operation only four employees per shift are necessary. For investors another big advantage is that such modular plants can be delivered within 8 to 10 months. The drawback of an over simplified design is that normally only three feed materials are possible (clinker, gypsum and one other material) and accordingly normally only one type of finished product such as standard OPC cement can be produced.

Today, in more sophisticated modular plant concepts the number of feed materials is less limited and also the number of finished products allows the production of several cements such as different OPC and blended cements. However, in this case the capacity of the grinding plant will also increase from less than 0.1 Mt/a up to 0.5 Mt/a and more. It goes within saying that in this case the number of modules will also increase and the number of 40 ft containers will easily exceed 10 and more (Figure 2). But these larger grinding plants have the modular plant concept in common with the smaller plants. Also in common are the advantages of a short time to market, the pre-assembled design and easy installation, commissioning and operation by using advanced automation control. Now, investors can choose plant concepts from different suppliers with different throughputs and technical features.

Figure 3 shows the plant modules structured by Gebr. Pfeiffer for their modular “ready2grind” cement grinding concept. All the equipment is also known from conventional VRM grinding plants [1]. It includes feed hoppers and weigh feeders for the raw material, conveyors, trap metal separators, bucket elevators and rotary feeders for the mill feeding, the core VRM with mill drive, product filter, mill fan, hot gas generator (HGG) and finally the product storage silos and related transports. For a modular design, the main challenge is to fit this equipment into standard containers and to allow an easy pre-assembly, installation and commissioning. When ball mill and VR mill concepts are compared, there are differences in the design. For example, in VRM concepts a dynamic separator is included in the mill, while in ball mill designs a separate classifier is necessary before the filter.

Base modules:

Grinding mill, as the core module, including classifier and mill drive

Feeding/dosing module including material transports and raw material supply

Filter system including mill/process fan, HGG (if necessary)

Electrical system, plant automation and control

Optional modules:

Cement transport, silos, bulk loading

Packing/palletizing system, bag loading

Weighbridges at entrance/dispatch

Auxiliary modules:

Cement laboratory

Maintenance and spare parts workshop

Water, compressed air and power supply

Office and rest rooms

3 Modular plant performance indicators

The Cemengal “Plug & Grind” concept now comprises three different grinding capacity ranges. The basic system is the “Classic” concept, which was launched in 2012 and comprises several modules in nine regular 40 ft containers with a ball mill 2.2 m in diameter and 9.5 m in length. The ball mill has an installed power of 500 kW and achieves 12 t/h of CEM I cement with 3200 cm2/g Blaine, corresponding to about 0.09 Mt/a. The “Plug & Grind” XL is for an annual production of about 0.22 Mt/a. It comprises eight regular 40 ft container and four special modules, of which one is a ball mill with 3.0 m diameter and 9.5 m length. The ball mill has a 1100 kW drive and achieves 30 t/h CEM I cement with 3200 cm2/g Blaine. The largest “Plug & Grind” is the Extreme, which is for a throughput of up to 0.39 Mt/a. It uses a ball mill 3.2 m in diameter, 11.5 m in length and with 1600 kW installed power, which produces up to 50 t/h CEM I (3200 cm2/g Blaine).

The Cemengal “Plug & Grind” design data are summarized in Table 1. Beside these data there are also other possible options. One option is the XPi4 module, which uses a Magotteaux 4th generation classifier instead of a standard classifier. Such classifiers allow the production of cements with up to 7000 cm2/g Blaine. Although Cemengal uses ball mills in their standard modular grinding concepts, it is also possible to use VRMs (Figure 4). In 2015 the “Plug & Grind” VP&G version was launched into the market. This concept with an installed power of 950 kW for the VRM is designed for 23 t/h CEM II of cement with 3800 cm2/g Blaine or 17 t/h of granulated blast furnace slag (GBFS). For a project in 2018 an OK Mill 37.3 with an installed power of 1600 kW at the mill shaft was used. This VRM achieves throughputs of 0.45 Mt/a.

In Table 2 the design data of the “ready2grind” concept of Gebr. Pfeiffer are summarized. The company offers three plant sizes in its concepts, always with an MVR vertical roller mill with four grinding rollers. The VRMs are supplied with a conventional drive with planetary gearbox. The smallest system is a R2G 1800 C-4 with 630 kW installed drive for up to 34 t/h cements with 4000 cm2/g Blaine. The R2G 2500 C-4 with 1450 kW drive achieves up to 79 t/h for cements with 4000 Blaine (Figure 5). The largest so far used VRM is the R2G 3000 C-4 with 1640 kW installed drive and 90 t/h for cements with 4000 Blaine. The MVR mill enables cement producers to grind all types of cement as well as slag, limestone, gypsum and many other materials. Due to their very smooth operation, MVR mills can produce cements with high fineness, such as CEM I with 5500 cm2/g Blaine. Due to the short residence time in the mill, quick product changes are possible. When the grinding rollers are regenerated, e.g. by re-welding outside the mill, the MVR mill can continue to operate with two of the four rollers at well over 50% throughput rate, which is unique.

Table 3 outlines the design data of the Loesche modular CCG (Compact Cement Grinding) plant concept. This concept comprises the three Loesche VRMs LM 15.2 CS, LM 24.2 CS and LM 30.2 CS. These mills have two rollers and are especially suitable for the grinding of clinker and slag (Figure 6). The mills give the potential owners a range of mill capacities from 12 t/h to 60 t/h depending on the mill size and product fineness. Loesche is furthermore transferring the modular CCG concept to coal grinding plants (CGP) and compact ore grinding plants (OCP). CMBI Sinoma, the other supplier for modular cement grinding plants, uses one ball mill type with a grinding capacity of 35 t/h or 0.25 Mt/a as well as a VRM with a capacity of up to 70 t/h or 0.5 Mt/a in its MMG concept (Modular & Mobile Grinding). While the specific power consumption of the ball mill is stated to be < 35 kWh/t, the one for the VRN is < 25 kWh/t.

4 Modular cement grinding plants around the world

Up to now there are four modular cement grinding plant suppliers on the market. The market leader is Cemengal with a market share of 54% in the period 2012 to April 2021 (Figure 7a). Gebr. Pfeiffer and Loesche each have 21% market share, while Sinoma is responsible for only 4%. However, Gebr. Pfeiffer, Loesche and Sinoma launched their technology onto the market several years later than Cemengal. If the last six years are taken, in which Gebr. Pfeiffer entered the market, the 40% market share of Cemengal is still very impressive (Figure 7b). However, the other suppliers have gained market share, especially Gebr. Pfeiffer and Loesche have succeeded in boosting their market share to 28%, each.

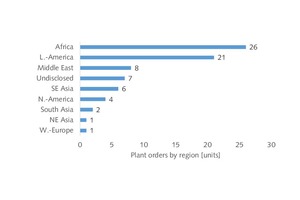

Figure 8 shows the development of the total 76 modular cement grinding plant orders over the years. The market increased steadily from two units in 2012 to 18 units in 2018. After 2018 the market cooled down significantly, especially in 2020, when only seven orders were awarded, probably caused by the Covid-19 pandemic. A breakdown of all modular cement grinding plants by regions is shown in Figure 9. In seven cases the countries and regions where the units are going to be installed were not disclosed. Up to now, from the remaining 69 units the majority are installed in Africa and Latin America. These two regions make up 68% of the known destinations. Still 12% are installed in the Middle East and 9% in SE Asia. Only a few modular plants are installed in the other regions including South Asia, NE Asia, North America and Western Europe. So far, no orders have been awarded from Eastern Europe, Central Asia, China and Oceania.

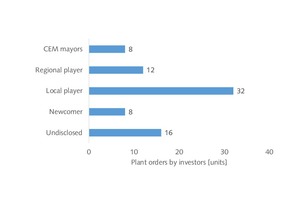

Figure 10 gives a breakdown of the modular cement grinding plant orders by the type of investors. 16 investors/clients of the plant suppliers were not disclosed (confidential), which indicates that some of the investors prefer not to give information to the market. However, for a huge majority of 60 projects the investors were disclosed. Of those 53% were local players, which means these cement producers operate just in one country. 13% of the investors were newcomers, either from the construction industry or other industries such as the steel industry. 20% of the orders were from regional players, who operate in a number of countries in a region and finally 13% were from cement majors, who operate globally. It is interesting to note that in total there were nine repeat orders, two investors ordered more than two plants and one even more than five. Two investors ordered from two suppliers and one even from three plant suppliers.

5 Two case studies

Plug&Grind, Cementos Melon, Chile

Cemengal installed their modular Plug&Grind (P&G) grinding plants mainly in Africa and Latin America, but there are also plants in Western Europe, the Middle East and SE Asia. For Cementos Melon in Chile two plants were installed, one in Punta Arenas and one at the Puerto Montt grinding terminal. The order for the P&G Extreme modular grinding plant at Puerto Montt was awarded in July 2017 and commissioning of the plant (Figure 11) was in November 2018 to achieve a fast grinding capacity upgrade of the terminal. The plant is designed for a production capacity of 250000 t/a of high Blaine cements for structural applications (Table 4) and comprises a ball mill with Ø 3.2 x 11.5 m and 1600k W drive, XP4i separator and bag filter for 50000 m³/h.The scope of supply included retrofitting of the existing feeding infrastructure, new feed hoppers for clinker and additives as well as a cement pneumatic transport to the existing storage silos.

Ready2Grind, Elementia-Cementos Fortaleza, Costa Rica

Mexican Elementia S.A.B. de C.V., which includes Cementos Fortaleza, awarded Gebr. Pfeiffer a contract for a “ready2grind” cement grinding plant in Caldera, Costa Rica (Figure 12) for an annual throughput of 0.3 Mt/a. The plant started operation in 2018 and is one of the first modular grinding plants provided by this supplier [3]. The core module is the MVR 2500-C4 vertical roller mill with integrated classifier, mill drive and other auxiliaries. In this plant, different types of cement are ground using clinker, limestone and several pozzolans. Accordingly, four hoppers are used for the raw material storage and three silos for the product storage. The other plant modules include the mill feed system, process filter and fan, a hot gas generator, a packing plant, a bulk loading system as well as the electrical controls and drives. Table 5 shows representative operational results with two cement types. For a CEM IV/A cement with 4500 cm2/g Blaine, a capacity of 61 t/h is achieved with a very low specific grinding energy requirement of only 15.9 kWh/t.

6 Market outlook

The market outlook for modular cement grinding plants after the Covid-19 pandemic is not very easy. On the one hand it can be seen that up to now 2018 was a peak year with 18 orders, followed by only eight orders in 2019 and seven orders in 2020. A reason could be that especially in the boom regions in Latin America and Africa there is some kind of market saturation. However, the market figures also indicate that the Middle East, South Asia with India, South East Asia, North America and Western Europe are in the trend. Especially in Western Europe and in North America, the ongoing discussions on greenhouse gas emissions and carbon reduction will probably force some cement plants with integrated clinker production to close and fuel the demand for imported clinker and subsequent cement grinding plants. This is further fuelled by the demand for reducing the clinker content in cement and to use the available cementitious products.

In countries such as India, where there has long been a high proportion of split grinding units, the advantages of modular cement grinding plants will be appreciated if the first operational projects are a success and will also show that the payback times are short to allow a quick return of investment. In this case we think there is a huge market potential in India. To some extent this is also true in other markets such as Vietnam, the Philippines or Indonesia, where either there is a high potential for split grinding plants or where cement distribution is a complete challenge. It will also be interesting to know what reasons have been behind the large number of orders up to now from Latin America, to understand how this knowledge can be transferred to other countries and regions. Therefore, one can feel optimistic for the future of modular cement grinding plants.