Outlook on ASEAN’s cement industry

Eight of the ten ASEAN countries have their own cement industry with significant clinker production. The countries can be split into mature, emerging and frontier countries, each one with its own characteristics. This market review will outline the latest figures of ASEAN’s cement industry and will describe major changes that are taking place in this region of the world.

1 Introduction

The Association of Southeast Asian Nations, or ASEAN, comprises ten countries, which, in their Vision 2020, agreed on living in peace, stability and prosperity, bonded together in partnership and dynamic development and in a community of caring societies. ASEAN maintains a close network of alliances and dialogue partners and organisations with similar aims around the world. The association is seen by many as the powerhouse in the Asia-Pacific region. In 2017, the ASEAN countries (Figure 1) comprised a total population of 642 million and had a gross domestic product of US$ 2.77 trillion, a GDP per capita of US$ 4308 and an average real GDP growth of 5.3 %, which is one of the largest of any regions in the world, second only to India (7.2 %) and China (6.8 %) and far above the world average of 2.5 % in that year.

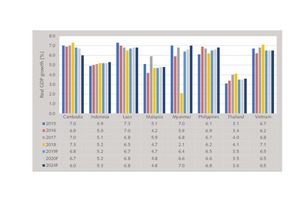

Of the ten countries, eight have a significant cement industry with their own clinker manufacturing, while the two countries Singapore and Brunei have either only cement storage capacities or cement grinding facilities [1]. The other eight can be classified into three different cement country groups, with 1 Mature: Malaysia and Thailand, 2 Emerging: Indonesia, the Philippines and Vietnam and 3 Frontier: Cambodia, Laos and Myanmar. Figure 2 shows the real GDP growth rates of these eight countries with a 5-year outlook. According to these data from the April 2019 World Economic Outlook (WEO) by the International Monetary Fund (IMF), the largest growth can be found in what we classified as frontier countries while the lowest GDP growth can be found in the more mature countries Malaysia and Thailand.

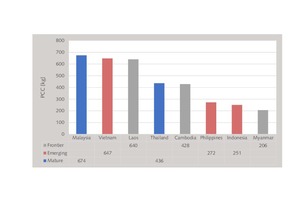

Often, the per capita cement consumption (PCC) is used as the criterion for classifying countries as mature, emerging or frontier. The latest data from 2017 (Figure 3) shows that this kind of information cannot strictly be used to classify the ASEAN countries. Malaysia, Vietnam and Laos have the largest PCCs in the ASEAN countries, while Indonesia, the Philippines and Myanmar have the largest deficits. The frontier countries have the largest span in the PCC, ranging from 640 kg in Laos to only 206 kg in Myanmar. In our classification we grouped the cement producing countries according to their cement demand growth over the last few years.

2 Mature ASEAN cement countries

2.1 Malaysia

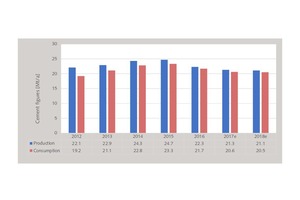

Since 2015, cement demand in Malaysia has continued to decline after a slight recovery at the beginning of this decade (Figure 4). Cement demand contracted by 2.8 million t (Mt/a) or 12 %, while cement production even contracted by 3.6 Mt/a or 15 %. The cement production capacity grew from 32.2 Mt/a in 2012 to 38.3 Mt/a in 2018, which is an increase of 19 %. Accordingly, the installed capacity has outgrown demand and last year the cement capacity utilisation stood at only 55 %. The average utilisation rate prior to 2016 was in the range of 67-72 %. The result was that sales prices came under pressure, especially due to the fact that there was a new entrant into the market, and in the current competitive environment and coupled with higher energy costs most companies have made losses from cement manufacturing.

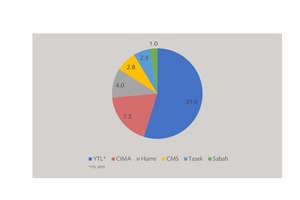

Figure 5 shows the distribution of cement capacity at the end of the first half of 2019. These figures do not include the white cement manufacturing capacity of Aalborg Portland Malaysia. YTL Cement has become the leader in grey cement with 21 Mt/a capacity and almost 55 % market share, after taking over 51 % of the shares of Lafarge Malaysia Berhad (LMB). LMB operated three integrated plants and two cement grinding plants with a combined capacity of 14.9 Mt/a. Second in the ranking is Cement Industries of Malaysia Berhard (CIMA) with three plants, followed by Hume Cement, which operate one plant that became operational in 2012. The other producers are CMS Cement with three plants and Tasek Corporation and Cement Industries Sabah, each with one plant. The three leading companies combine 84 % of the capacity, and accordingly cement production is now highly concentrated.

2.2 Thailand

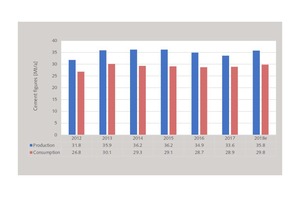

Thailand’s cement demand slightly recovered in 2018, after years of stagnation or decline (Figure 6).

For 2019 and 2020 the market is expected to grow by another 2.5 to 3.0 % in each year, according to Thailand’s Cement Manufacturers Association (TCMA). From 2012 to 2018 cement demand increased by 3.0 Mt/a or 11 %, while cement production increased by 4.0 Mt/a or 13 %. In this period, governmental spending was responsible for 35-40 % of the volume, while residential & commercial spending accounted for 60-65 %. At the moment, the PCC stands at 451 kg. In the TCMA projection the PCC is expected to grow to 476 kg by 2020, which is much higher than the average level of mature cement countries, which is between 250 and 400 kg.

Thailand has seven cement producers with a total production capacity of nearly 60 Mt/a from 13 plants, excluding one white cement plant with 0.85 Mt/a capacity. The leading producer with a market share of 38 % of the capacity is the Siam Cement Group (SCG) with 23 Mt/a capacity from five plants (Figure 7). Second in the ranking is Siam City Cement (SCCC), which has 17.0 Mt/a capacity and operates three cement plants with six kilns in Kang Koi District and Saraburi Province. Third in the ranking is TPI Polene with one plant and 13 Mt/a capacity. The Top 3 combine 88 % of the cement capacity. No. 4 HeidelbergCement has become a shareholder in Jalapathran Cement after the acquisition of Italcementi. Furthermore, the company has a 49 % shareholding in Asia Cement and accounts for a cement capacity of 5.8 Mt/a from its three shareholding plants. The other Thai cement producers are Tai Pride Cement and Samukkee Cement, both with one plant.

3 Emerging ASEAN cement countries

3.1 Indonesia

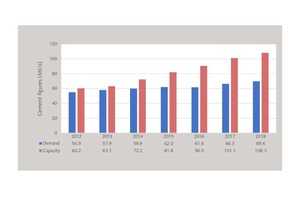

Driven by the strong population growth and growing middle class, the cement demand in Indonesia increased from 54.9 Mt/a in 2012 to 69.6 Mt/a in 2018. This is an impressive growth of 27 % (Figure 8).

The retail (residential) sector is still the largest consumer of cement in Indonesia. However, in the last few years cement growth has not fulfilled the expectations, especially in 2016, when there was a 0.6 % decline in demand. In the last two years growth has recovered in the key markets of West Java, Central Java and Sumatra. Anyhow, cement capacity grew much stronger than demand [2], from a capacity of 60.2 Mt/a in 2012 to 108.2 Mt/a in 2018. This is a capacity growth of nearly 48 Mt/a or 80 % in just seven years. Accordingly, capacity utilisation significantly declined from 91 % to 68 % in 2017, so that newcomers made cash losses.

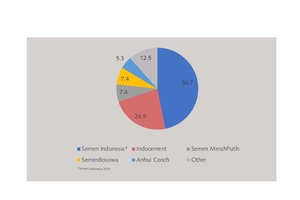

Semen Indonesia is the leading cement producer (Figure 9), with a market share of almost 47 % and a capacity of 50.7 Mt/a after the acquisition of Holcim Indonesia. The company operates a cement capacity of 35.9 Mt/a and has four integrated cement plants (Figure 10) in Indarung (West Sumatra), Tuban (East Java), Pangkep (South Sulawesi) and Rembang (Central Java), plus another three grinding plants. A further four integrated plants with 14.8 Mt/a are to be acquired from Holcim. Second in the ranking is PT Indocement Tunggal Prakasa, which is a member of HeidelbergCement, with 24.9 Mt/a capacity from 13 kiln lines in three cement plants. The two leading producers are followed by Semen Merah Putih, Semen Bosowa and Anhui Conch Indonesia as well as nine other cement producers, including Semen Jawa, which is a member of the Siam Cement Group, and Semen Garuda, which is part of China’s Jui Shin Group.

3.2 Vietnam

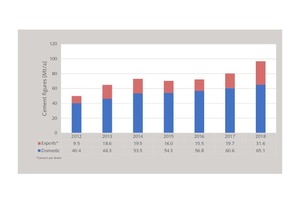

Vietnam is the second largest cement market in the ASEAN countries and possibly the largest cement producer (Figure 11). The domestic cement demand increased from 40.4 Mt/a in 2012 to 65.1 Mt/a in 2018, which is a growth of 24.7 Mt/a or 61 %. The exports, which include cement and clinker, increased from 9.5 Mt/a to 31.6 Mt/a, which corresponds to a growth of 233 %. However, in the last few years growth has not been stable. The largest growth in cement demand was in 2013 and 2014 with 14.6 and 15.6 % respectively. The lowest growth was in 2012 and 2015 with -1.8 % and 1.5 %, respectively. In 2018, cement demand was largest in the Northern region with a 40 % market share, followed by the Southern region with 34 % and finally 26 % for the Central and Central Highlands region. Cement and clinker exports boomed in the last two years with growth rates of 27.2 and 60.4 %, respectively.

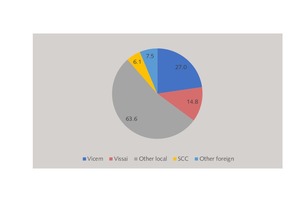

In Vietnam there are more than 100 cement plants (excluding mini cement) with a total capacity of 119 Mt/a (Figure 12). The majority are small to medium scale plants with capacities of less than 1 Mt/a [3]. The largest producer is the state-owned Vicem, which has a market share of 23 % of cement capacity and operates ten plants with 16 production lines and 20 Mt/a clinker capacity and 27 Mt/a cement capacity (Figure 13). Second in the ranking is the local Vissai Group, which has a capacity of 14.8 Mt/a. In 2017, phase 1 of Song Lam Cement with 4.7 Mt/a capacity and the Nghi Tiet grinding plant with 3.8 Mt/a capacity were made operational. The other local producers include Xuan Thanh cement, beside more than 40 other separate companies. Xuan Thanh inaugurated a massive 12500 t/d cement plant in October 2017 and plans to install further large lines. The main foreign producers are SCCC and SGC from Thailand, as well as companies from Japan and China.

3.3 The Philippines

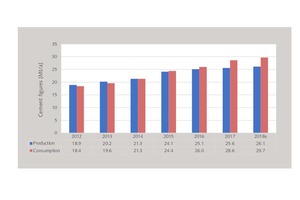

The Philippines have developed from a cement exporter to a cement importer (Figure 14). Cement production increased from 18.9 Mt/a in 2012 to 26.1 Mt/a in 2018, which is an increase of 7.2 Mt/a or 38 %, while cement demand increased from 18.4 Mt/a to 29.7 Mt/a, which is a rise of 11.3 Mt/a or 61 %. In 2017, 3.0 Mt/a of cement were imported, while in 2018 this figure is estimated to be 3.5 Mt/a. It is expected that for the next few years and probably as a long-term outlook the economic growth and market fundamentals of the construction and cement industry will be robust. Residential construction was responsible for about 50 % of demand, non-residential for 15 % and infrastructure for 35 %. In the last few years the market has been especially driven by a strong performance in the housing sector of Visayas with its capital Cebu and Mindanao with its capital Davao. However, due to imports and growing competition cement prices have come under pressure.

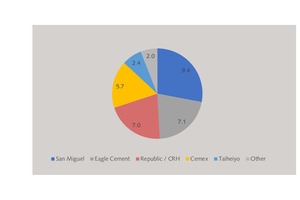

The cement capacity of the Philippines stood at 33.6 Mt/a at the end of 2018 (Figure 15). “Newcomer” San Miguel Corp. has become the leading player in the market after its acquisition of 85.73 % of Holcim Philippines for US$ 2.15 billion (P112.4 billion) in May 2019. Holcim operated five cement plants with a combined clinker capacity of 5.2 Mt/a and 9.4 Mt/a cement. Interestingly, San Miguel is also a shareholder in the no. 2 in the market, Eagle Cement, which now account for 9.1 Mt/a cement capacity after finishing their no. 3 kiln line in Bubacan last year. Accordingly, with their holdings after the deal San Miguel will control nearly 50 % of cement capacity in the Philippines. Republic Cement (Figure 16), in which Irish CRH holds a 45 % stake, has fallen behind with 7.0 Mt/a capacity and 20.8 % market share. Cemex is the no. 4 in the ranking with 5.7 Mt/a capacity and 17 % market share, followed by Taiheiyo from Japan with 7.1 % market share. The other three producers Northern Cement, Mabuhay and Goodfound Cement just combine the 6 % market share.

4 Frontier ASEAN cement countries

The frontier countries Cambodia, Laos and Myanmar will benefit significantly from the Chinese “Belt and Road” initiative [4]. In all these three countries, construction has already been one of the leading sectors driving GDP growth in the last few years. Urban population is now growing after some kind of mismanagement for decades. The cement industry in these countries used to be characterized by small and relatively old and inefficient plants. However, for some years now a change has been taking place. Table 1 contains the actual situation of the cement industry in these countries in 2018. At the moment the old and new cement plants are not able to cover demand. In total these countries have a nameplate cement capacity of 26.0 Mt/a, but only 15.3 Mt/a were produced, although demand was about 28 Mt/a. The average capacity utilisation rate was 58.8 %, while the lowest was in Laos with only 55.3 %.

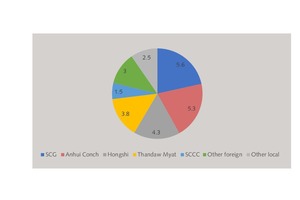

The producer’s landscape in these countries is undergoing a dramatic change. Former local companies are teaming up more and more with foreign cement producers and investors. The largest capacities are already held by foreign companies (Figure 17). The largest producer is SCG from Thailand with 5.6 Mt/a capacity from three plants in Cambodia, Laos and Myanmar and a market share of 21.5 %. China’s Conch Cement also has a participation in these three countries (Figure 18) and achieved a market share of 20.4 %, while two more plants are under construction. China’s Honghi follows with 16.5 % market share from two plants in Laos. Fourth in the ranking is Myanmar’s Thandaw Myat, which has a JV with Chinese Jian Sheng Investment. Finally, Thailand’s SCCC is in the Top 5 with one plant in Cambodia (Figure 19). Other foreign producers account for 11.5 % market share and other local producers are now down to less than 10 % market share.

5 Outlook on ASEAN’s cement industry

In the coming five years it can be expected that the cement industry in ASEAN will have average growth rates similar to the GDP growth of 5 to 6 %. The more mature countries Malaysia and Thailand will fall behind this growth, while the emerging and frontier countries will grow faster. Probably, Myanmar will also be able to follow the growth path again when its political struggles have been solved. Despite the fact that there are already overcapacities in some of the countries, further capacity expansions will take place in all ASEAN emerging and frontier countries, as there are still a number of projects under construction and more projects have been announced. According to our information major capacity expansions will continue in Indonesia, Vietnam and the Philippines. In Cambodia, Laos and Myanmar it is expected that especially Chinese investors will install additional cement capacity.

One of the major trends of the last few years has been the consolidation of cement capacities in the ASEAN countries and the divestment of large groups such as LafargeHolcim (LH) in ASEAN or Cemex Thailand. The divestment of capacities by LH in Thailand, Malaysia, the Philippines and Vietnam caused changes in the local competitive structure of these countries, especially because the assets were taken over by the leading producers such as SCG, YTL and San Miguel. It can be questioned whether the other still present Western cement majors, such as HeidelbergCement, CRH and Cemex, will follow the LH example. Anyhow, one discernible trend is that the leading local producers such as SCG, SCCC, Semen Indonesia and YTL are further consolidating in the mature markets and continuing to expand in emerging and frontier markets. Another trend is that new local and Chinese investors are entering ASEAN’s cement industry.

//www.onestone.consulting" target="_blank" >www.onestone.consulting:www.onestone.consulting