The impact of Covid-19 on the alternative fuels industry

The paper describes the impact of Covid-19 on the alternative fuel industry and consequently the cement industry using alternative fuels. Supply chain problems, falling fossil fuel prices and decreasing cement sales are currently hampering the use of alternative fuels. From a climate perspective, the trend towards higher substitution rates must continue.

Introduction

Never before has modern society seen itself confronted with a crisis comparable to the impact Covid-19 has had on our daily lives. Never before have there been such restrictions and limitations on our actions and our economies on a global scale. SARS-CoV-2, the newest Coronavirus, has demonstrated our vulnerability.

It has also distracted us from another, less sudden but more severe catastrophe, that we will have to face in the near future: climate change. What it entails comes slowly, however not less drastic: Droughts, heatwaves (Siberia experienced a record 38° C in June) and floods are just some of the consequences.

Meanwhile, due to the lockdown during peak numbers of Covid-19 cases, we most likely experienced the largest ever annual fall in CO2 emissions [1], more than during any previous economic crisis or period of war. But this is a temporary decrease, and “even this would not come close to bringing the 1.5C global temperature limit within reach”, according to Carbon Brief [1].

One might ask how this information is related to the cement industry. Among industry professionals it is common knowledge by now that the global cement industry accounts for between 5 and 10 % (values vary between sources) of anthropogenic CO2 emissions and is therefore one of the main contributors to climate change. At the same time, global clinker production is expected to increase significantly, from 3.27 billion metric tons in 2010 to 4.83 billion metric tons in 2030 [2]. In 2019, global production reached 4.2 billion metric tons [3].

There are two aspects of cement production that result in emissions of CO2. The first is the chemical reaction involved in the production of the main component of cement, clinker. These so-called “process emissions” contribute an estimated 5 % of total anthropogenic CO2 emissions excluding land use change and present approximately 40 % of CO2 emissions from cement production.

The second source of emissions is the combustion of fossil fuels to generate the significant energy required to heat the raw ingredients to well over 1000° C. These “energy” emissions, including those from purchased electricity, could add additional 60 % on top of the process emissions [4].

Approximately 40 % of the so-called “process emissions” which result from the use of fossil fuels such as gas, coal and oil can be reduced by the use of alternative fuels. This is a great potential.

And cement manufacturers around the world have realized this potential. In India, for example, several companies set specific goals for thermal substitution rates and other emission lowering measures. Mr Mahendra Singhi, the Managing Director and CEO of Dalmia Cement (Bharat) Limited, a cement manufacturing company with around 27 million tons of annual capacity, declared at the UN climate conference in 2019 that the company would be CO2 neutral by 2040. LafageHolcim aims to reduce CO2 emissions from current 561 kilograms per ton of clinker to 520 tons by 2030 [8]. HeidelbergCement’s goal is to reduce its specific CO2 emissions per ton of cement by 30 % compared with the 1990 level by the year 2030. In 2018, a reduction of around 20% was achieved. In line with this goal, the group launched an “Alternative Fuel Master Plan” project in 2018. Meanwhile, China, which accounts for 55 % of global cement production, sets its focus on carbon capture and storage, as emission trading opportunities become scarce [9].

Aside from the apparent advantage of lowering emissions, the main levers for alternative fuel implementation and higher substitution rates are availability, high fossil fuel prices compared to alternative fuels, and cement demand. And this is where the consequences of Covid-19 come into play.

Alternative fuels availability

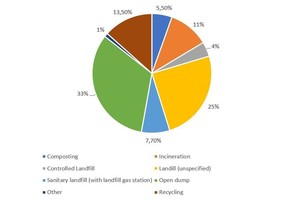

According to the World Bank report “What a Waste 2.0” from 2018, around 40 % of global waste generation are landfilled. Only about 19 % are recycled or composted and a further 11 % is burned. 33 % are disposed of in so-called “open dumps”.

As devastating as this sounds, these are ideal conditions and a great potential for the cement industry. Co-processing of these great amounts of previously unused waste not only replaces fossil fuels use, it also offers a solution to the waste management issue.

However, in order to generate the waste for co-processing, waste collection and treatment systems need to be installed. In many low-income countries, this is still not the case.

Countries in which effective waste collection systems are in place often suffer from a surplus of waste, which has previously mainly been shipped to Asian countries. Especially since China’s plastic waste ban, a lot of western countries rely on waste exports, while co-incineration plants rely on waste imports.

International trade has definitely suffered from the Covid-19 lockdowns. The Federal Statistical Office of Germany released numbers at the beginning of June, according to which Germany sees the highest slumps in export sales since the start of foreign trade in 1950. The value of goods exports fell 31.1 % year-on-year to € 75.7 billion [10]. According to the World Trade Organization (WTO), world trade could decline by 13 to 32 % this year, depending on the course of the corona pandemic [11].

In waste trade, importers have shown hesitance for a short period of time as it had not been clear to what extent contaminated wastes might cause a further spread of the virus. Given the strict regulations and precautions in waste handling, these concerns dissolved over time.

Nevertheless, Covid-19 had a significant impact on cross border trade of alternative fuels. Given that many cement manufacturers aim to increase their alternative fuels use, the lack in availability caused prices to rise.

Alternative fuel prices

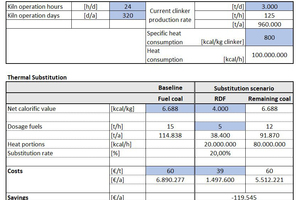

Alternative fuel prices are influenced by several factors. As part of a study that MVW Lechtenberg & Partner has just completed for the Ministry of Energy of the Kingdom of Saudi Arabia, the costs for a “fuel switch” for the cement industry were calculated. This includes the capital and operational expenditures that accrue when subsidized fossil heavy fuel oil is replaced by refuse derived alternative fuels (RDF).

In addition to the costs for the required infrastructure, like waste treatment plants for shredding, sifting and screening the waste, the required investments in the plants for storage, dosing and feeding of alternative fuels, changes to the burners and process technology, as well as transportation need to be considered. Out of these, a “price at the flame” for alternative fuels can be calculated. This price does not include gate fees for waste treatment, as in most countries only low prices are charged.

In this report, results indicate a “price at the flame” for RDF of around 39 US$ per ton at a calorific value of 4000 kcal per kilogram.

This price might of course vary depending on costs for energy, technology and labour. However, if modern process technology according to “The BAT (Best Available Techniques) Reference Document (BREF), entitled ‘Waste Treatments Industries’” [12] is used, these calculated costs are to be expected.

Alternative fuel prices vs fossil fuel prices

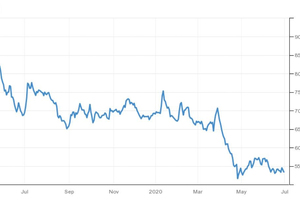

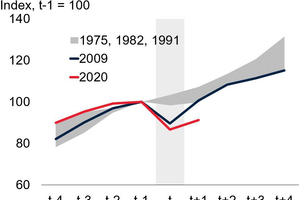

It is especially due to Covid-19 that fossil fuel prices are currently plummeting, causing an important lever for alternative fuels implementation to become ineffective. To name just one example, coal prices dropped to 50 US$ per ton – a historical low, as shown in Figure 2 [13].

Comparing the profitability of alternative fuels as mentioned before to the current coal prices in their “Corona Low”, a cement producer would actually even make a loss when switching to alternative fuels (compare Figure 3).

Cement demand

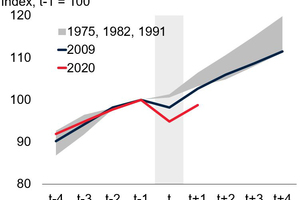

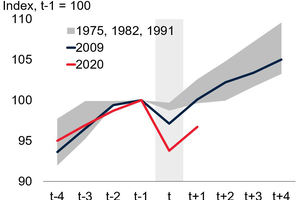

Cement demand has a direct impact on alternative fuels implementation as the willingness to invest depends on steady revenue and sales. Generally, cement demand is tightly connected to the Gross Domestic Product (GDP). Forecasts on GDP by the World Bank suggest that the COVID-19 recession will involve a 6.2 % decline in global per capita GDP, making it the deepest global recession since 1945-46, and more than twice as deep as the recession associated with the global financial crisis (compare Figure 4).

The decline in GDP as an indicator for economic growth suggests that the construction and building markets, on which the cement industry depends, are expected to shrink along with it.

According to the “Covid-19 Impact Analysis CIC 2025” issued by OneStone Consulting, global cement production will see a decline of 9.3 % in 2020 compared to 2019. The decrease in China, the largest cement manufacturer in the world, is projected to be 8.5 %. However, according to the report, this is a continuation of China’s supply side demand changes [15].

Especially in the immediate future, capacity utilisation in 2020 is expected to crash. China will see a decline in capacity utilisation of 4 % compared to 2019. For the rest of the world it will be a slump of 7 % in 2020 compared to the previous year [15].

Due to the cement overcapacity accumulated in recent years, there will be no shortage in cement supply, but closure of cement plants will be necessary to remain profitable.

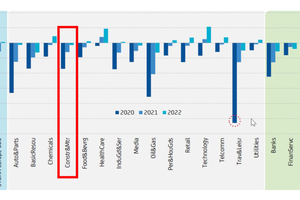

UniCredit analysts expect a decrease in expected profits in the sector “construction and materials” of 35 % for 2020, 15 % in 2021 and 3 % in 2022 compared to 2019 (compare Figure 5). Less profits suggest a lower willingness to invest. Cement demand is therefore another lever of alternative fuels implementation impacted by Covid-19.

Summary and outlook

What will be the long-term consequences of the pandemic for the “alternative fuels industry”, including equipment suppliers for waste treatment machinery, mechanical and industrial engineering companies, as well as waste management companies?

There are several decisive factors determining the industry’s future development:

1. Availability of waste material – which, despite Covid-19, is guaranteed given global waste volumes

2. Fossil fuel prices – which are expected to remain counterproductively low

3. Cement demand – which is expected to decrease but bounce back eventually

4. Depending on cement demand: The willingness to invest

5. And finally, legislative initiatives as well as subsidies to push the use of alternative fuels for an environmentally friendly “fuel switch”

Covid-19 has definitely had an impact on our industry, as it had on most economic sectors. Its consequences will continue to be noticeable over the coming 1-2 years, if not longer – depending on when the virus’ spread will be contained. However, current analyses and reports such as those cited in this article expect a normalization of the situation sooner or later.

Aside from the economic aspects which – unfortunately but understandably – still are the main lever for a “fuel switch”, the environmental aspects should not be disregarded.

Legislative incentives such as subsidies for alternative fuels use and limitations for fossil fuels use could push forward the industry’s development. Aside from the impact of Covid-19, we unfortunately see a lot of counterproductive measures.

China, for example, has announced to fuel its economy with the currently cheap coal. The USA withdrew from the Paris Agreement. The German Government is implementing a rushed and little thought-through “coal-exit”. In Europe, legislations are planned to no longer rank co-processing as climate-friendly, as it is not in line with a “circular economy”. According to experts, waste should not be burned but recycled and fed back to the raw material cycle. The questions that remain are: which technique would be able to process the waste? And at what cost and additional energy demand? A sustainable waste treatment as it is offered by using the wastes in the cement industry would be taken ad absurdum.

Covid-19 might influence environmental developments in the foreseeable future in two ways; it could either drown concerns regarding climate change and CO2 emission reduction efforts, or it could remind us of our vulnerability to nature and prompt us to accelerate the emission reductions we have seen during the lockdown.

In other aspects, such as digitalization, the pandemic has definitely caused a kick-start for long overdue developments. It has shown us what we can achieve when we are forced to. With climate change, this should be no different.

//www.lechtenberg-partner.de" target="_blank" >www.lechtenberg-partner.de:www.lechtenberg-partner.de