Alternative fuel market after Covid-19 – focus on efficiency and quality

As Covid-19 has changed the way people interact with each other and the way business is done, it has also affected the market for alternative fuels. Now is the time to change paradigm regarding alternative fuel projects towards a more holistic approach in order to ensure investment efficiency.

The commodities market

Covid-19 has impacted the world in so many different ways, affecting the market for alternative fuels both directly and indirectly. Oil prices have dropped to an all-time low and, in spite of efforts from OPEC+, demand is not expected to recover to pre-Covid-19 levels, with prices potentially stabilizing at a lower level. Coal prices have also been affected, even if not as strongly as crude oil prices due to a more stable demand for electricity from coal-fired power plants. Nevertheless, also coal prices are expected to sustainably fall down to 17% (World Bank Group, April, 2020), which could negatively affect investments related to co-processing alternative fuels (Figure 1).

Locally produced alternative fuels – a win-win game under certain conditions

In spite of reduced fossil fuel prices, the need to secure supply chains and decrease dependency from oil and coal might motivate the development of more locally produced fuels. Additionally, CO2 allowances are due to be reduced and prices are therefore expected to go up as we enter the 4th trading period of the European Emissions Trading System in 2021.

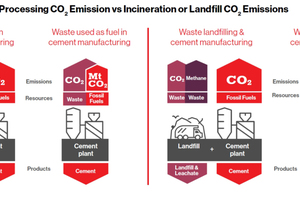

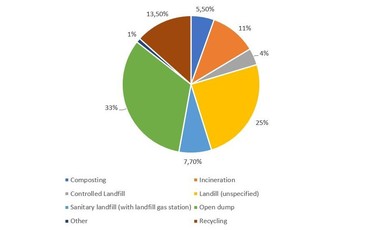

Fuel emissions account for approximately 35% to 40% of total CO2 emissions from cement manufacturing. In cement production energy is simultaneously recovered and minerals are recycled from a variety of waste streams. Co-processing puts the cement industry at the heart of the circular economy, and plays a key role in terms of waste management in local areas and municipalities. CO2 is saved by replacing fossil fuels with the alternative waste streams, but also through those emissions not being made through incineration or through methane emissions from landfill (Figures 2 and 3).

This means that co-processing is one of the fundamental practices on the way to sustainable waste management and CO2 emissions reduction, and not necessarily only for the biogenic fraction.

Additionally, as seen above, alternative fuels will also play a significant role with a potential of 44% reduction in CO2 emissions from clinker manufacturing until 2050.

This is good news towards a more sustainable waste management worldwide – provided governments take this opportunity to reform regulations, reorganise responsibilities and make the process more transparent for stakeholders, thus facilitating future investments.

The use of biomass and pre-processed waste as fuels in cement production varies greatly across different regions. Countries in which cement plants operate with a high thermal substitution rate (TSR) by alternative fuels have typically implemented policies that focus on setting emissions limits and preventing unregulated landfilling instead of restricting the characteristics of alternative fuels for industrial use. This approach allows cement plants or industrial operators the flexibility to use the alternative fuel combination that they find most cost-competitive and suitable to meet the legislation. For instance, the alternative fuel share in the cement thermal energy demand in countries such as Germany or the Czech Republic is reported at more than 60% (IEA, CSI, WBCSD, 2018), while the average TSR in Europe is 46%, and in the world, only 18% (based on available GNR-GCCA Data). This shows that there is a lot of potential for increasing alternative fuel utilization.

Investment landscape – efficiency is key

In Covid-19 times cash is the order of the day – all over the world we have experienced an investment stop for new projects and many current ones have come to a halt, including some related to alternative fuels. There are many different possible scenarios for economic recovery after the crisis; however, it is too early to allow for reliable prognostics. The depth of the recession and the speed of recovery, along with specific strategies, policies and incentives will determine where, when and how such investments will be resumed. New, possibly shorter ROI targets will challenge such projects, especially in view of lower fossil fuel prices.

In spite of that, the talk is of a “green recovery”. Now, more than ever, there is widespread awareness concerning environmental issues. Political, financial and corporate measures and guidelines will keep putting pressure towards higher TSRs. Within this new scenario, co-processing industries such as cement and lime will need to ensure the efficiency of the investments which they do make. This means that industries co-processing alternative fuels might have to rethink internal bidding processes and project set-up. This ensures that the concept takes all aspects into consideration which will influence its sustainability within the plant. Medium to long term goals, permitting situation, ownership, alternative fuel availability and quality, maintenance and manpower requirements, storage capacity, quality control and modularity are just some of them.

The Central European or high-TSR case

These aspects vary in importance depending on the level of co-processing and development stage of alternative fuel conditioning at each location. Take central Europe, for instance: with high average substitution rates and an established alternative fuel market, the goal is to achieve those last percentage points aiming at economic advantages both coming from reduced costs as compared to fossil fuels and from a CO2-emissions standpoint. Waste management systems and alternative fuel conditioning companies are mature and well-established. The supply chain is known, quality monitored and mostly quite reliable. From the end-user point of view, it is important to focus on advanced technological solutions in order to guarantee good combustion conditions without negatively affecting the final product.

This includes performing a technical assessment, which consists of a detailed analysis of the kiln process, taking into account kiln set-up, raw material specifications, fuels’ specifications, CFD modelling of the kiln processes and burner set-ups in order to predict possible influences on clinker quality, logistics, etc. Additionally, very high-quality alternative fuels must be used in order to keep clinker quality within acceptable levels. Factors such as calorific value, fuel and ash composition, conveying and combustion properties play an even more crucial role at this TSR level.

As mentioned in a previous article in ZKG’s special edition for alternative fuels in 2018, the Loesche Group Company A TEC, Austria not only has great expertise related to the cement kiln pyroprocess – also focusing on increasing TSR – it is also able to perform all necessary process modifications in order to achieve this. Another of A TEC’s strengths is illustrated by its Rocket Mill® technology, designed to produce high-quality waste-derived fuels with special characteristics that allow very high substitution rates.

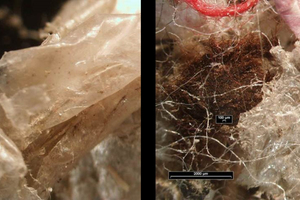

A TEC’s Rocket Mill can grind pre-sorted, shredded household and commercial waste with a bulk density of 100 – 300 kg/m³ to a size of 15 mm, with 50 % < 5 mm, in one pass. The preparation process not only provides size reduction and increases the specific surface area of the waste material, but has also a drying effect of up to 10%, giving better ignition and combustion properties – key factors when striving to achieve high TSRs. The difference between materials from a cutting mill and from the A TEC’s Rocket Mill is depicted in the microscopic photos of Figure 4.

Together with Aixergee’s (a Loesche Group Company as well) vast experience and simulation and analysis capabilities, these two companies can provide the full range of products and services required at this stage.

A side note on digitalization

Higher profitability and cost reduction have always been important goals for the cement industry – now (in Covid-19 times) and in the recovery period, more so than ever.

Aiming at tackling the above-mentioned parameters, Loesche has taken a significant step in broadening its portfolio of tailor-made equipment and services, and recently became a majority shareholder of Kingsblue GmbH & Co. KG, a company located in Hilden/Germany with subsidiaries in China and the USA. Kingsblue specializes in providing smart digital solutions, particularly for the heavy industry.

Based on a one-time data transformation and categorization process as input for its plant management platform (PMP) and spare part platform (SPP) and using algorithms for risk and performance parameter evaluation along with search time reduction, plant availability can be significantly increased while keeping lower amounts of spare parts. This results not only in sizeable savings, but also increases robustness towards crisis scenarios such as Covid-19, where plant personnel is reduced to a minimum and data availability along with reduced searching times is crucial.

The low- or zero-TSR case

In regions where TSR levels are still very low or even zero, the situation changes quite a bit in comparison to the high-TSR case. Here, although quality requirements for alternative fuels are not as strict, many more external factors need to be taken into account when planning investments.

Usually the waste management system is not mature and there are few incentives to generate suitable alternative fuels out of waste streams. However, these are usually the regions where waste represents a very critical sanitary issue and which are, therefore, under great international pressure to invest in sustainable solutions, of which the conditioning and usage of alternative fuels plays a prominent role. This is mostly, but not only the case in low-income countries: take China, for example – the lack of incentives is a very limiting factor in the development of local waste conditioning and generation of alternative fuels, in spite of 5 year plan goals to increase TSR in the cement industry.

The three factors below should be carefully considered while planning projects involving alternative fuels in such regions:

1. Waste Management System and Legal Framework: missing waste management system, need-based disposal fees, as well as permits for co-processing industries which facilitate use of alternative fuels, etc.

2. Primary energy and CO2 prices: primary energy prices are directly related to the ROI of investments in alternative fuel systems. As mentioned before, CO2 emissions have started to significantly affect overall production costs and can therefore act as a driver towards higher substitution rates

3. Cement market: the situation regarding supply and demand in a specific market influences the strategy regarding alternative fuels. If the plant is not producing at full capacity, lower quality alternative fuels (higher moisture and high subsidy fee) might be utilized

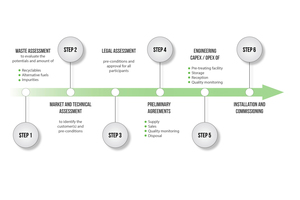

In order to guarantee investment efficiency, a holistic approach is paramount. In this case, there are many different stakeholders and their drivers and limitations need to be considered while setting up a project (Figure 5). The main milestones are listed below:

The first step would be a detailed waste assessment, which compiles information regarding waste sources, ownership, characteristics, availability, seasonality, logistics, recycling potential and its resulting demand for conditioning steps, as well as disposal fees, etc.

The second step would be a market and technical assessment in order to identify possible customers and their specific requirements. Following that, a legal assessment should be carried out to understand and abide by local regulations in order to obtain necessary permits.

Both results – from waste and technical assessment – define the demand and concept for pre-processing the waste streams and the necessary investment. After that, preliminary agreements should be signed covering the supply of alternative fuels, prices, quality requirements and monitoring and disposal of non-conform loads.

Steps five and six represent the usual project development stages with consideration of costs, logistics, and storage, through project award and installation and commissioning.

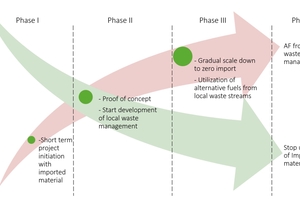

If local regulations allow alternative fuel import, then characteristics, costs, logistics, etc. need to be identified and taken into account within the planning steps. If, on the other hand, the alternative fuels need to be produced out of locally available waste streams, the process becomes much more complex and implementation can take longer. Nevertheless, in accordance with the Basel Convention, using local waste streams is the most sustainable approach and should be aimed for as a long-term strategy. There is, however, a possibility of shortening this process by combining the two (Figure 6).

Phase I: Start of alternative fuel utilization using imported material on a time-limited permit. Adaption and gradual increase of cement plant operation with alternative fuels can be achieved. Simultaneously the legal framework should be revised in order to promote utilization of local waste streams and their conditioning into alternative fuels. Efforts for social acceptance of state-of-the-art co-firing practices, involvement of local informal sector must be initiated

Phase II: proof of concept for alternative fuel utilization. Possible negotiation of longer-term take-off agreements for locally conditioned material, which enables financing for new waste conditioning plants

Phase III: start utilization of local alternative fuels, gradual scale down of imports. Common development with local companies in order to fulfill quality and constancy requirements

Phase IV: complete stop of alternative fuel imports. TSR increase based solely on locally conditioned material

As the above-mentioned factors show, this is a much more complex structure in terms of project development. The Loesche Group and its partners are able to support its clients throughout the entire process, offering:

Waste assessment, design of the pre-treating facility, materials management and support in alternative fuel specification and procurement (e.g. in partnership with WhiteLabel-Tandem Projects)

Technical assessment of pyroprocess and necessary modifications

Process diagnostics and data collection

Waste conditioning and handling solutions (at the end user’s plant or offsite)

Prolonged on-site support and training of up to 1 year after commissioning to ensure optimum operation and handover

Operation and maintenance

Financial services

Keynote

Covid-19 has changed the way people interact with each other and the way business is done. Now is the time to change paradigm regarding alternative fuel projects towards a more holistic approach in order to ensure investment efficiency. Simple and cheap (at first) shall give way to smart, flexible and sustainable concepts. Suppliers shall give way to partners.

![1 Development of South African coal prices [https://www.indexmundi.com/commodities/?commodity=coal-south-african&months=60 access on June 3rd, 2020]](https://www.zkg.de/imgs/1/5/8/2/6/7/1/tok_ee1a9fcd8d117f612eeab33d1e7a7789/w300_h200_x600_y201_Figure_1_-Indexmundi_Screenshot-b22a30562f4d9205.jpeg)