Gypsum – a scarce raw material?

The premature decommissioning of power plants in Europe and elsewhere along with the corresponding sharp decrease in the quantities of flue gas desulphurization (FGD) gypsum are stoking fears that in a few years’ time there won’t be enough gypsum available for a growing market. In the following report, we look at the current global figures and, especially for Europe, we gauge the future prospects and what developments may be necessary.

1 Introduction

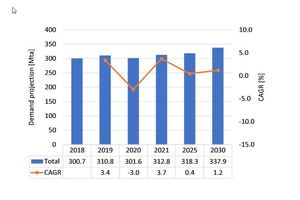

Gypsum is a key raw material needed in large quantities in the cement industry, the gypsum plasterboard industry, for other gypsum building products, and in agriculture. Figure 1 shows how the global demand for gypsum will change over the next years [1]. According to this, gypsum consumption will increase from 310.8 million t per year (Mt/a) in 2019 to around 337.9 Mt/a in 2030. Because of the pandemic, consumption decreased by around 3% in 2020, but the market recovered markedly in 2021. In 2019, the cement industry, where gypsum is used primarily as a setting regulator, used 166.0 Mt/a, accounting for around 53.4% of the demand for gypsum, followed by the gypsum plasterboard industry with 112.6 Mt/a or 28.3%. In the forthcoming years, on account of the forecast peak in the cement industry in China, the global quantities required by the cement industry will decrease, however, the quantities needed for the gypsum plasterboard industry as well as those for other industries will increase.

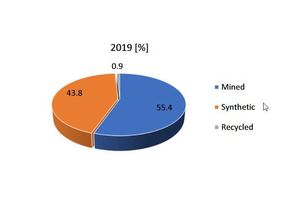

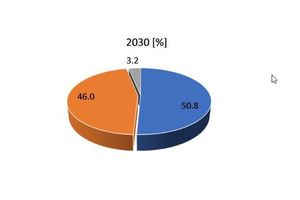

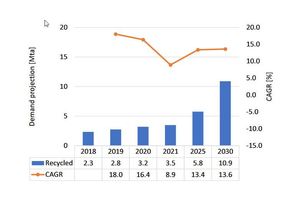

Figure 2 shows how, starting from the situation in 2019, a forecast for the global demand for gypsum as a raw material gypsum in the year 2030 can look. According to this, the percentages for natural gypsum will decrease from 55.4% to 50.8%, although in absolute terms, the production of natural gypsum will only decrease insignificantly from 173.1 Mt/a in 2019 to 171.8 Mt/a. The use of synthetic gypsum will not only increase in percentage terms by 2.4%, but also clearly overall from 136.8 Mt/a to 155.7 Mt/a. At first glance, this may not be apparent as losses for FGD gypsum are forecast, however, there are numerous sources for synthetic gypsum. For gypsum recycling, high growth rates from a low level to 3.2% and absolute quantities of around 11 M/ta are expected.

2 Production of natural gypsum

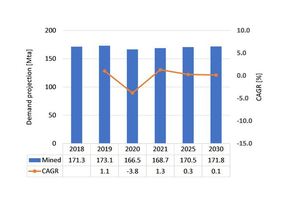

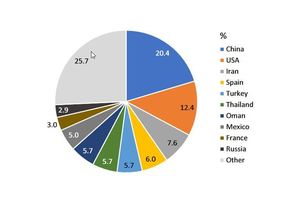

Figure 3 shows the forecast curve for global production of natural gypsum up to 2030. In 2020, on account of the pandemic, the quantities produced fell by -3.8% to 166.5 Mt/a. For 2021, a slight recovery by 1.3% to 168.7 Mt/a resulted. In contrast, over the years 2025 to 2030, only a smaller further increase in production quantities is expected. The major production countries for natural gypsum are shown in Figure 4. China leads the field, with a global market share of 20.4%, followed by the USA and Iran. The TOP 10 countries make up a market share of around 75%. Some of the previously important countries, such as Thailand and South Africa, will continue to lose ground as the resources available there have already been largely exhausted. The winners include countries like Oman and Iran, which still hold extensive reserves (Figure 5).

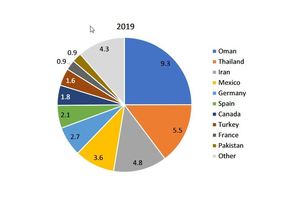

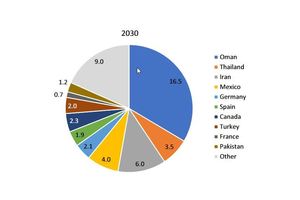

This will also have an effect on the most important export countries for natural gypsum. In Figure 6, the TOP 10 export countries for 2019 and 2030 are shown. Overall, exports totalled 37.3 Mt/a in 2019. Up to 2030, exports will probably increase to 49.2 Mt/a. Oman may be able to almost double its exports from 9.3 Mt/a in 2019 to 16.5 Mt/a. Iran’s exports will also increase substantially from 4.8 Mt/a to around 6.0 Mt/a. The countries with higher export rates up to 2030 will include Mexico, Canada, Turkey and Pakistan. Considerable losses are expected for Thailand. After 5.5 Mt/a natural gypsum exports in 2019, a maximum of 3.5 Mt/a are expected by 2030. Germany will also reduce its export rates, too, as less FGD gypsum is available for domestic industry and this must be offset to an extent by more natural gypsum.

3 FGD gypsum and other synthetic gypsum

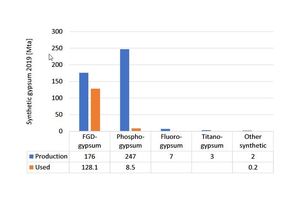

In the desulphurization of flue gases and various chemical processes, e.g. the production of hydrofluoric acid and phosphoric acid or the processing of dilute acid from titanium dioxide production, sometimes large quantities of synthetic gypsum are produced as a by-product. One speciality is evaporite gypsum, which is formed during the evaporation of seawater for the production of salts. In 2019, a total of around 435 Mt/a synthetic gypsum was produced worldwide (Figure 7). Of this quantity, 136.8 Mt/a or 31.4% were used in industry. Of the 176 Mt/a FGD gypsum produced, 72.8% were used worldwide. In the case of phosphogypsum, of the quantity of 247 Mt/a produced, only 3.4% were used in the cement and gypsum industry. All other chemical gypsums, such as fluorogypsum, titanogypsum and others, have not yet been used in industry on account of harmful impurities. Evaporite gypsum has so far been used mainly in India.

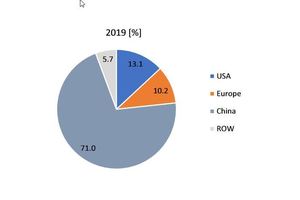

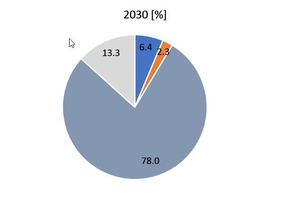

Coal-fired power plants currently still constitute the most important source of energy for the generation of electricity in many countries in the world. In countries like China, India and in various countries in Southeast Asia, more coal-fired power plants are being built. According to the International Energy Agency (IEA), depending on the CO2 scenario, the global power plant output will rise from 7484 GW in 2019 to between 13400 and 16550 GW by the year 2040. FGD plants are also currently being upgraded in countries like India, Australia and South Africa (Figure 8), which have so far not used the technology. Therefore, this forecast expects that worldwide FGD gypsum quantities will only decrease insignificantly from 176 Mt/a in 2019 to 173 Mt/a in 2030. Figure 9 shows what share the countries and regions will have in this time period. Losses in North America and Europe contrast with gains in China and the rest of the world (ROW).

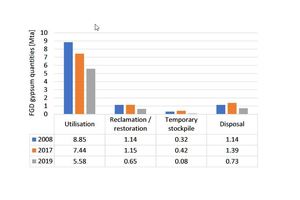

Interesting is that not all the FGD is being used by a long way. Figure 10 shows how the figures have changed in recent years in EU 15 (Western Europe). The quantity of FGD gypsum produced fell from 11.45 Mt/a in 2008 to 7.04 Mt/a in 2019, the recycling rates increased from 77.3% to 79.3% in the same period. A not insignificant part of production, amounting to 1.14 Mt/a in 2008 and still 0.65 Mt/a now, is sent to so-called mono-landfills, where the FGD gypsum is not mixed with other substances. Similarly large quantities are sent for disposal, that is to landfills where the FGD gypsum is mixed with, for example, fly ash of inferior quality. The latter FGD gypsum from mixed landfills is lost for later recycling. The gypsum from mono-landfills, on the other hand, can be utilized at a later date.

Estimates assume that in Germany alone around 18.0 million t (Mt) FGD have been sent to mono-landfills over the last 20 years. The biggest mono-landfills in Germany are located at lignite-fired power plants. One of these is found in Jänschwalde. The gypsum landfill there, Jänschwalde II, has been run since 2011 in two-shift operation for the FGD gypsum from LEAG’s Jänschwalde 6 x 500 MW lignite-fired power plant. The delivered gypsum is placed in the landfill by means of a rail-mounted spreader (Figure 11) and reclaimed with a wheel-loader (Figure 12). Depending on the location and form of the gypsum landfill, reclaimers can be used for loading the gypsum at other sites. In the planning, it is expected that gypsum can be extracted from such mono-landfills without any detriment to its quality for up to at least ten years.

4 Gypsum recycling

Although there are practically no limitations on the recyclability of gypsum, on a global scale, only very small quantities of gypsum have been recycled so far (Figure 13). But here there is also great potential for growth. In Germany, according to a recent monitoring report headed “Kreislaufwirtschaft Bau” on recycling in the construction industry, around 0.64 million t gypsum waste are produced annually, but only 0.03 million t or 4.7% of this are recycled. Gypsum waste is produced, for example, at construction sites as cuttings during the installation of gypsum plasterboards as well as during the refurbishment or demolition of buildings. On account of its sulphate content, gypsum waste should be collected separately from other construction waste and recycled. The problem here is that the gypsum from gypsum plasterboard and gypsum wallboard can be easily recycled, whereas gypsum from aerated and cellular concrete, gypsum fibreboard, screed and gypsum plaster has so far been mostly completely unsuitable for recycling.

Figure 14 shows a schematic of the process stages at a typical plant for recycling gypsum waste. The main process stages are pre-sorting of the gypsum waste, magnetic separation for the removal of any metallic impurities like nails and screws, various comminution stages and subsequent classification and separation of other impurities. The quality requirements of the gypsum industry for recycled gypsum can be practically only met if the content of impurities in the delivered gypsum waste is at least lower than 5%. Problematic are mineral impurities, as found when aerated concrete or screed is processed, while foreign substances such as paper, cardboard, plastics, timber and insulation materials can be removed comparatively easily on account of the difference in density to gypsum. In the case of gypsum fibreboard, the problem is that the paper fibres cannot be removed. If single-origin separation is possible, however, gypsum fibreboard can be comminuted and returned to fibreboard production [5].

New West Gypsum can be regarded as one of the pioneering companies in gypsum recycling. A first plant went into operation in Canada in 1985. Today, the company is represented with ten gypsum recycling plants (Figure 15), not only in Canada, but in Belgium, Germany, England, France and Norway. The average quantity processed at one of these plants is 25 t/h or 0.1 Mt/a. More than 5 million t gypsum have so far been recycled by the company, the annual rate is just under 0.5 Mt/a. In Germany, Remondis is one of the leading companies in gypsum recycling. At its Zweibrücken site, a state-of-the-art plant (Fig. 16) with a capacity up to 72000 t material has gone into operation. 85% of the input material is processed to recycled gypsum. Leftover materials like paper, plastic or metal are also recycled.

The leading companies in the recycling of gypsum plasterboard are the manufacturers of gypsum plaster board Knauf, Saint Gobain, and ETEX. Knauf took the top spot here in Great Britain and Scandinavia back in 2015. For example, in Denmark, a recycling rate of 17% was achieved while in Norway a rate of 14% could be reached. With its brand Siniat, which evolved from the takeover of Lafarge Plasterboard and comprises 35 plaster board factories, ETEX has set a new record in Great Britain. The percentage of recycled gypsum (RG) was increased to 18.4% in 2020. For this, a quantity of 0.131 Mt/a gypsum was recycled in the plants at Bristol (Figure 17) and Ferrybridge, UK. For 2025, a recycling rate of 30% is planned at Siniat in England. Saint Gobain has shown especially through its subsidiary Gyproc that the recycling rates can be increased considerably if return and collection systems for plasterboard are introduced.

5 Technology developments

Whereas the technology for the recycling of gypsum waste can now be regarded as the state of the art, with regard to the processing or cleaning of phosphogypsum, that level is still a long way away. Phosphogypsum is a by-product in the production of fertilizer in the preparation of phosphoric acid from phosphate rock. The processes for the production of wet phosphoric acid production are differentiated based on the form of the precipitation of calcium sulphate as dihydrate, hemihydrate or anhydrite. For each tonne of phosphoric acid, depending on the process, between 4.5 and 5.5 t gypsum is formed. There are more than 200 different phosphate minerals. Most of the rock phosphates used are weakly radioactive and also contain impurities, which can concentrate in the gypsum product. Problematic are primarily the radionuclides radon-226 and lead-210 as well as high contents of residual phosphate.

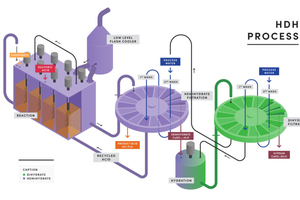

There are various processes for the removal or neutralization of impurities in phosphogypsum. In Prayon’s HDH process (Figure 18), a high product yield of 98-99% P2O5 and a good-quality gypsum is obtained from the outset. Moreover, Prayon also supplies downstream processes. First, these concern classifying of the gypsum, to remove the impurities that concentrate in the coarse grain, and second the washing and removal of soluble components such as residual phosphate, fluorine and sodium. Classification has proven to be a potential method for the reduction of the radon-226 content, as baryte, which is contained in the rock phosphate, enriches radon-226, tends to agglomerate and can be removed by screening. Positive results have also been returned by sorting processes by means of gamma spectroscopy, to remove material with excessively high radiological values.

6 Outlook

The raw material gypsum is already scarce today and will in future become even scarcer,especially in countries and regions such as Europe, North America and Japan. But by the year 2030, supply should be secure. This is firstly because on a global scale the quantities of FGD gypsum remain largely unchanged, and reserves in the use of FGD gypsum still exist in Europe and the USA. In addition, in some cases, large quantities of FGD gypsum are stored in mono-landfills and can still be used for a relatively long time without any detriment to its quality. Besides FGD gypsum, there are still sufficient quantities of natural gypsum in many countries. The gypsum recycling rates can be increased considerably. Finally there are good possibilities for processing and recycling phosphogypsum, too. After 2030, the use of recycled gypsum and phosphogypsum will have a greater significance.

![4 Overview of the gypsum recycling process [4]](https://www.zkg.de/imgs/1/8/3/3/2/9/4/tok_b905317946f28d949cbbda8736704e54/w300_h200_x600_y269_14_137134025_79c5a8623d-d44e9aa5bb1b512e.jpeg)