The Future of Calcined Clay by 2035 and 2050

The market for clay calcination is booming. However, up to now the production is not more than 0.05% of the global cement production, although it has been projected that by 2050 a global market share of 8% could be achieved. Is this still realistic? What are the main prospects and existing market barriers? Answers to these questions and more information is given in the following article.

1 Introduction

The world climate goals require action now. Limestone calcined clay cement is a promising alternative to Portland cement and one of the best solutions for creating value and reducing carbon emissions by the cement industry. However, in 2023 only about 2.1 million t (Mt/a) of calcined clay were produced worldwide, which is less than 0.05% of all cement constituents such as clinker, gypsum, limestone and the supplementary cementitious materials (SCMs). However, the IEA (International Energy Agency) projected in a technology roadmap a few years ago that by 2050 calcined clay could make up 8% of the global cement constituents, resulting in a production of 375 Mt/a. Accordingly, what needs to be done to achieve a market share for calcined clay of 8% in 2050? If this cannot be achieved, what is realistic? Detailed market information has been provided in a new report [1], which can be regarded as a blueprint for companies who want to invest in this sector.

2 Calcined clay and LC3 cements

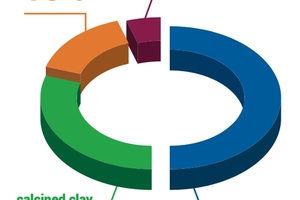

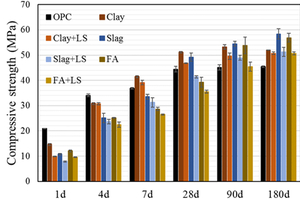

Limestone calcined clay cement or LC3 is a new type of cement that is based on a blend of limestone, calcined clay, gypsum and clinker (Figure 1) [2]. LC3 can reduce CO2 emissions of conventional Portland cements by up to 43% using limestone and low-grade clays, which are available in abundant quantities. LC3 is a family of cements. The figure in LC3-50 refers to the clinker content, it is made up of 50% clinker and 30% calcined clay. After 1-28 d or longer, it has a very similar compressive strength development to Portland cement (Figure 2). However, after the first day the compressive strength of LC3 can be significantly lower than that of Portland cement, while after 7 and 28 d the compressive strength of LC3 can develop favourably and exceed that of Portland cement.

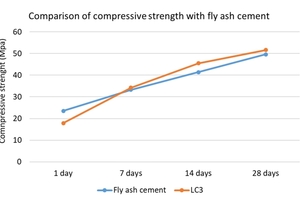

In its compressive strength development, LC3 is also very similar to fly ash (FA) cements or slag binary and ternary cements based on 50% clinker, 30% SCMs and 15% limestone (LS). This has been tested by a number of companies. Holcim tested the compressive strength development of fly ash cements and LC3 cements (the fly ash cement contains 65% clinker and 35% fly ash and gypsum, while the limestone calcined clay cement contains 50% clinker, 33% calcined clay and 17% limestone and gypsum [3]. Fig. 3 impressively shows the performance of calcined clay cements. However, also in this case, after 1 day the compressive strength was lower than that for fly ash cement, while from 7 d and longer it was higher. Anyhow, the standardisation of this kind of cements is now included in the EN 197-5 (2021), ASTM C695 and ASTM C618.

3 Technology aspects

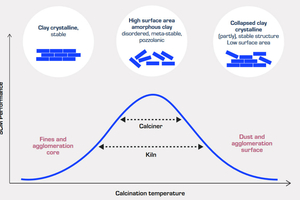

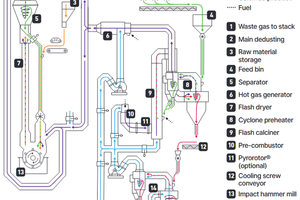

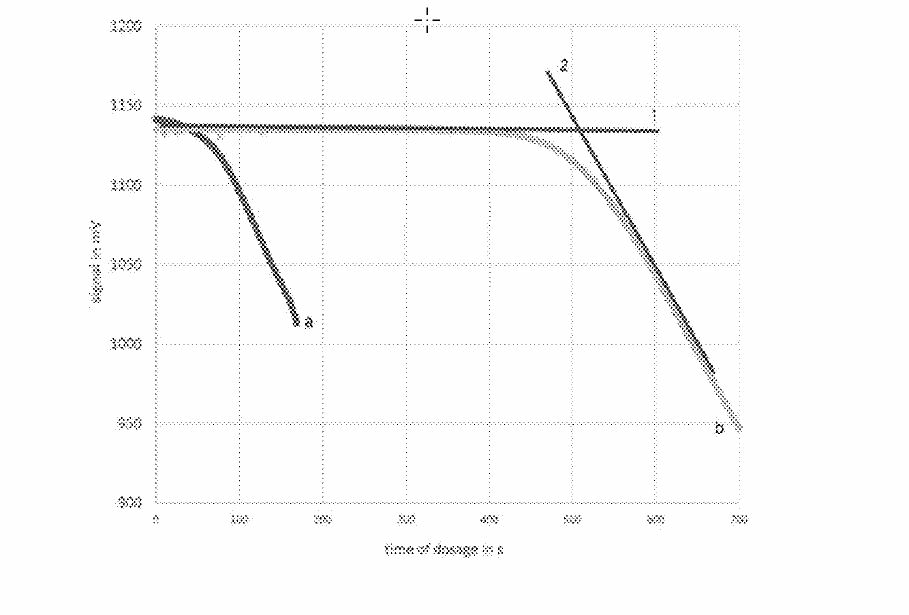

The production of calcined clay is already well advanced. For thermal calcination three different methods exist. Calcination in a rotary kiln, in a flash calciner or via an electrical technology, which is currently under development. Rotary kilns and flash calciners are known from the cement and lime industries. The production is cost effective and does not require capital intensive modifications to existing cement plants. At present, there are more than 10 different suppliers on the market and the number increases year by year. Clay calcination requires only about 60% of the energy which is needed for clinker production, but its calcination temperatures have to be kept within a small temperature range. The residence time therefore has to be carefully controlled to achieve this optimum temperature range (Figure 4). The technologies for drying and preparation of the raw clay are important. Long distances from the clay quarry to the processing plant make the process less economical.

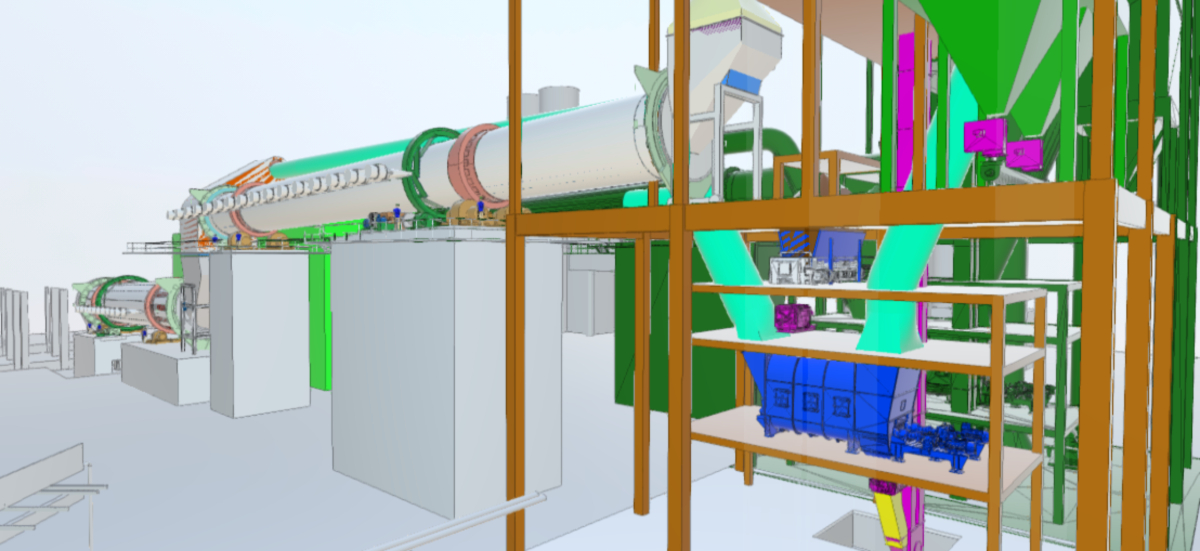

Up to now, the plant capacities for clay calcination are in a relatively low range when compared with capacities of cement kilns, which can exceed 12000 t/d. With larger capacities and utilisation rates, kilns operate more economically and can achieve a lower specific energy consumption and less specific emissions. A few technology suppliers are working on this subject. This is especially true for flash calcining systems, which up to now have not been available for capacities above 1500 t/d. KHD Humboldt Wedag AG is developing a flash calcination system for calcined clay, which uses three or more cyclone preheaters upstream of the flash calciner (Figure 5) [5]. The idea behind this is to perform only a minimum of calcination in the flash system, while most of the temperature increase of the clay material is achieved by the cyclone preheaters. Such systems could allow much higher capacities for clay calcination of 4500 t/d and more.

4 Status of calcined clay production plants

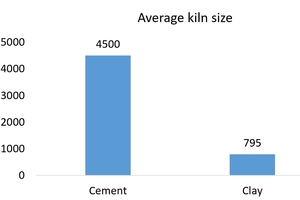

In their new market report, OneStone Consulting analysed that in 2023 a total of only 14 clay calcination plants were operational worldwide. Most of the plants were in Latin America, followed by Western Europe and Africa. The total capacity of these plants was 3.45 Mt/a, while the average kiln size was only 795 t/d. Only 2.1 Mt/a of calcined clay were produced, which is not more than the production of one large cement plant and results in a capacity utilisation rate of 60.9%. The economies of scale between cement kilns and clay calcination kilns are very different. Clinker plants are now being built with capacities of 4500 to 10000 t/d or even larger. Globally, the average size of a cement kiln is almost 4500 t/d compared to 795 t/d in clay calcination (Figure 6). The plant sizes clearly have to increase. Technically this is possible, the limits are in the small temperature range and residence time. Economically, the limits are the smaller capacities of clay quarries compared to limestone quarries.

The analysis of the existing plants shows that the majority use rotary kilns, while up to now, only 2 use a flash calciner. A number of the rotary kilns were existing units or kiln conversions. In the Sobradinho clay calcination plant (Figure 7) owned by Brazil’s Ciplan, which is part of the Vicat Group, a high-quality kaolinitic clay with 25% moisture is processed. The rotary kiln has a nominal capacity of 550 t/d and achieves 700 t/d after optimisation [6]. Operational since 2009, the kiln uses petcoke as fuel. The specific energy consumption is about 550 kcal/kg. The Rio Claro clay calcination kiln (Figure 8) owned by Cementos Argos in Colombia has been operational since 2020. It is the largest rotary calciner in an existing kiln line, with 1500 t/d and a nominal capacity of 0.45 Mt/a. Petcoke and pulverized coal are used as fuel, the specific energy consumption is 570 kcal/kg.

The world’s first greenfield flash clay calciner was commissioned in 2023 at the Kribi plant (Figure 9) in Cameroon by Cimpor, which is now part of Taiwan’s TCC Group. The plant has a capacity of 720 t/d, while optimisation of the throughput and specific energy consumption are still an ongoing process [7]. The plant uses natural gas as fuel and shall have a calcined clay cement production capacity of 2400 t/d. Holcim Česko will build a calcined clay processing line in Čížkovice in the Czech Rep. (Figure 10) for completion by the end of 2026. Gebr. Pfeiffer has received an order to supply a MVR 1800 C-4 vertical roller mill for calcined clay grinding Plant construction will start in January 2025 for an investment of US$ 44m with a financial support of CZK 330m (US$ 14.5m) by the Czech Modernisation Fund of the Ministry for Environment. Interestingly, this plant is also of a smaller size, with 360 t/d.

FLSmidth recently commissioned a clay calcination plant for CBI in the Port of Tema in Ghana. The plant, which is equipped with a flash calcination system (Figure 11) has a capacity of 0.405 Mt/a, what makes it the largest operational clay calcination plant, worldwide. CBI produces the Supercem cement brand. The investment costs were given with US$ 80m, Norfund sponsored 77.4 MNOK in the project. The calcined clay shall substitute about 30% of clinker, which has been imported before. CBI Ghana has been founded in 2017 and is operating a grinding plant, while producing the Supercem cement brand in accordance with the GS 1118:2016 and EN 197 standards. The grinding plant has been built between June 2017 and December 2018 at a cost of US$ 50 million. In 2022 Heidelberg Materials acquired a 50% stake in CBI Ghana Ltd.

The world’s largest new clay calcination plant with a capacity of 3000 t/d is to be constructed in Brazil for Circlua S.A., located in Minas Gerais in Belo Horizonte. The company aims to decarbonize the construction industry by upcycling mining waste into drop-in components for clean building. Circlua has entrusted thyssenkrupp Polysius to perform a front-end engineering design (FEED)-contract for the construction of this plant. Circlua is supported by the global mining company Vale, who intends to utilize materials derived from mining waste (Figure 12) and turn them into sustainable solutions. The calcination plant shall be located in the Brazilian state of Pará, where the high-quality clay will be sourced and upcycled from the gigantic clay reserves of the iron ore complex of the Carajás mine for the production of activated clay as a supplementary cementitious material (SCM).

Holcim is becoming a pioneer in the area of clay calcination with the largest known number of plants announced. Other main producers are Cimpor, Vicat, Cementos Argos, Votorantim and CIMAF. Holcim is the industrial leader with 14 projects, which are planned to be operational by 2030. Three projects (Tabasco in Mexico and Saint-Pierre la Cour and Le Malle in France) are already operational with a combined capacity of 1360 t/d. We estimate that all 14 plants will have a total capacity of 8140 t/d. Cimpor has 2 projects operationg in the Ivory Coast and Cameroon with a combined capacity of 1680 t/d. Two more projects shall be operational by 2030 in Ghana and Souselas in Portugal with a combined clay calcination capacity of 2680 t/d. Vicat has 3 plants operational (2 in Sobradinho in Brazil and one in Xeuilley in France) with a combined capacity of 2725 t/d. Another plant with an estimated 1000 t/d is planned in Lebec, USA.

5 Prospects and market barriers

Today, the main market barriers for a significant market expansion of clay calcination plants are the installation costs, concerns regarding the compressive strengths of clay cements, low funding schemes, poor LC3 application knowledge and eventually the procedure for receiving the mining rights. All these parameters are very different from country to country or region to region. Anyhow, calcined clay brings producers distinct advantages, offering cement producers a reduction of their carbon footprint by lowering their clinker production when producing/marketing LC3 cements. A low-carbon cement product which helps to meet low-carbon targets and commitments and improve customer relationships can be developed and introduced to the market. A higher percentage of calcined clay can be blended with clinker than is the case with some other SCM materials. In some locations it may be less expensive to produce calcined clay than to buy or import fly ash or GBFS (price development, higher quality and concrete performance).

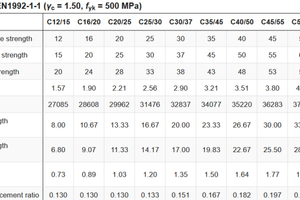

According to ECOS, the Environmental Coalition of Standards, green public procurement (GPP) is still under-exploited today [8]. More than half of public contracts across the EU are awarded without the environment and decarbonisation in mind. The situation that we see in GPP just reflects our standards and regulations for allowing the use of performance cements. Today, many cements are not produced to suit what is needed, while a wide range of concrete design properties is available (Figure 13). Experts such as the World Cement Association (WCA) found that roughly 40 to 50% of the global production is used for low risk and low strength applications. Applications can be fulfilled to a large extent with C25/30 concrete or smaller. C25/30 concrete has a strength of 30 MP/a after 28 d, making it hard wearing and suitable for a range of commercial and industrial applications.

Anyhow, improving the production of calcined clay while reducing the clinker factor should be getting a better promotion and needs a change in policies. The governments should decide on tax breaks for the production of calcined clay and the supply and use of LC3 cements. This should include tax credits for the production of LC3, as well as accelerated depreciation schemes for calcined clay investments and LC3 facilities and equipment, thus reducing taxable income and tax liabilities to provide a higher short-term cash flow. On an international scale, there are a few examples for funding clay calcination projects, such as in the USA or in Africa. In Europe, not much funding of clay calcination has been received up to now, although billons of Euros were already announced by the EU Innovation Fund for several CCS/CCUS projects. On a national scale, only a few loans have been given to clay calcination projects - for example in France, Germany or the Czech Republic.

6 Market outlook

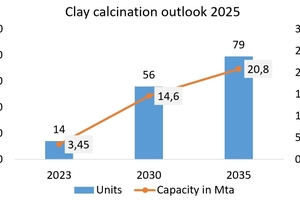

Figure 14 shows our projection for calcined clay by the year 2035. Corresponding to the identified projects and company announcements up to October 2024, the number of clay calcination plants will increase from 14 units to 56 units by 2030 and 79 units by 2035. The calcination capacity will increase to 14.6 Mt/a by 2030 and 20.6 Mt/a by 2035. Correspondingly, the average kiln capacity will increase to 839 t/d by 2030 and 859 t/d by 2035. The reason for the slight increase in capacities is that even large cement companies are still planning plants with low capacities of 350 to 450 t/d. An economic reason is that many existing rotary kilns still have to be converted and that most of the clay quarries in proximity to those plants have a relatively low quarry size and capacity. Due to the unknown market acceptance, it is uncertain what the future capacity utilisation rates of the new plants will be. In our projection by 2035 we see a slight increase but still with rates below 67%.

The IEA estimated in their Roadmap 2050 a cement consumption in 2050 (2DS case) of 4682 Mt/a, of which 8% is calcined clay, corresponding to almost 375 Mt/a of calcined clay [4]. The projected clinker to cement ratio has been given as 60%, which means that 2809 Mt/a of clinker and 1873 Mt/a of other constituents has to be produced. According to our projection [9], the cement production in 2050 will be close to 3850 Mt/a and a clinker factor of 67-68% (2599 Mt/a clinker) is more realistic, while a 3% share of calcined clay requires that 115 Mt/a have to be produced. However, a 3% calcined clay share by 2050 requires 350 more clay calcination plants (1200 t/d average capacity and 75% capacity utilisation) from 2035 to 2050 (15 years), which corresponds to 21 to 25 new plants per year. Today, the largest clay calcination orders have sizes of 1280 for flash technology and 1600 t/d for rotary kilns. However, we expect larger sizes in the future.

7 Summary

Reduction of the clinker factor in cement production by using calcined clay is a viable option [10]. However, in 2023 only 2.1 Mt/a of calcined clay were produced, which corresponds to only 0.052% of the annual cement production. In our projection for 2030 the global number of calcined clay plants will increase from 14 (2023) to 56 units (33 are already in the planning stage), while in the projection for 2035 the global number of calcined clay plants will further increase to 79 units with a capacity of 20.8 Mt/a and an estimated production of 13.7 Mt/a. This will increase the cement constituent’s share from 0.052 to 0.36%. The 3% share of calcined clay by 2050 will need 350 more plants (1200 t/d average capacity and 75% capacity utilisation) from 2035 to 2050 (this corresponds to 15 years), or between 21 to 25 new plants per year. Anyhow, the future development will largely depend on the promotion of calcined clay by producers, governments, funding agencies, equipment suppliers and the public.

December 2024, Varna, Bulgaria

for Sustainable Development, Paris & Geneva.

10-11. October 2024, Madird, Spain

Last update: 5th Edition, April 2025, Varna, Bulgaria